Introduction: Revolutionizing Indian Financial Landscape through OCEN

In the dynamic landscape of Indian finance, a groundbreaking solution emerged in January 2020, altering the very fabric of the nation’s credit scene. Nandan Nilekani’s unveiling of the Open Credit Enablement System (OCEN) marked a pivotal moment, addressing India’s substantial 250 billion dollar credit gap. Developed by iSpirit, India’s non-profit software think tank, OCEN stands as a beacon of financial inclusivity, a beacon that holds the promise of democratizing the flow of credit to both Micro, Small, and Medium Enterprises (MSMEs) and individuals alike.

Imagine a bustling Indian marketplace where a small artisan, let’s call her Maya, crafts intricate handmade jewelry. Maya dreams of expanding her small business, and reaching a broader audience, but her aspirations are often stymied due to the lack of accessible credit. Herein lies the crux of the problem: a vast credit gap preventing countless entrepreneurs like Maya from realizing their full potential.

OCEN, a revolutionary API framework ingeniously built upon India’s Digital Public Infrastructure (DPI), utilizing the Aadhar identification layer and UPI payment gateway, emerges as the solution to this pressing issue. It redefines the interactions between lenders and borrowers, transforming the traditional lending landscape. By leveraging OCEN, financial institutions can seamlessly provide customizable small token loans with short tenures to the MSME sector. This innovative approach not only empowers entrepreneurs like Maya but also significantly contributes to reducing interest rates. The reduction in operational and overhead costs, facilitated by OCEN’s streamlined processes, has a direct impact on the affordability of credit, making it more accessible to those who need it the most.

In essence, OCEN epitomizes the vision of a financially inclusive India, where barriers to credit are dismantled, and the dreams of countless entrepreneurs, like Maya, can thrive. This transformative system signifies more than just a technological advancement; it represents a societal shift towards empowering individuals and businesses, driving the nation towards a future where financial opportunities are limitless.

Will OCEN revolutionize the digital lending ecosystem in India?

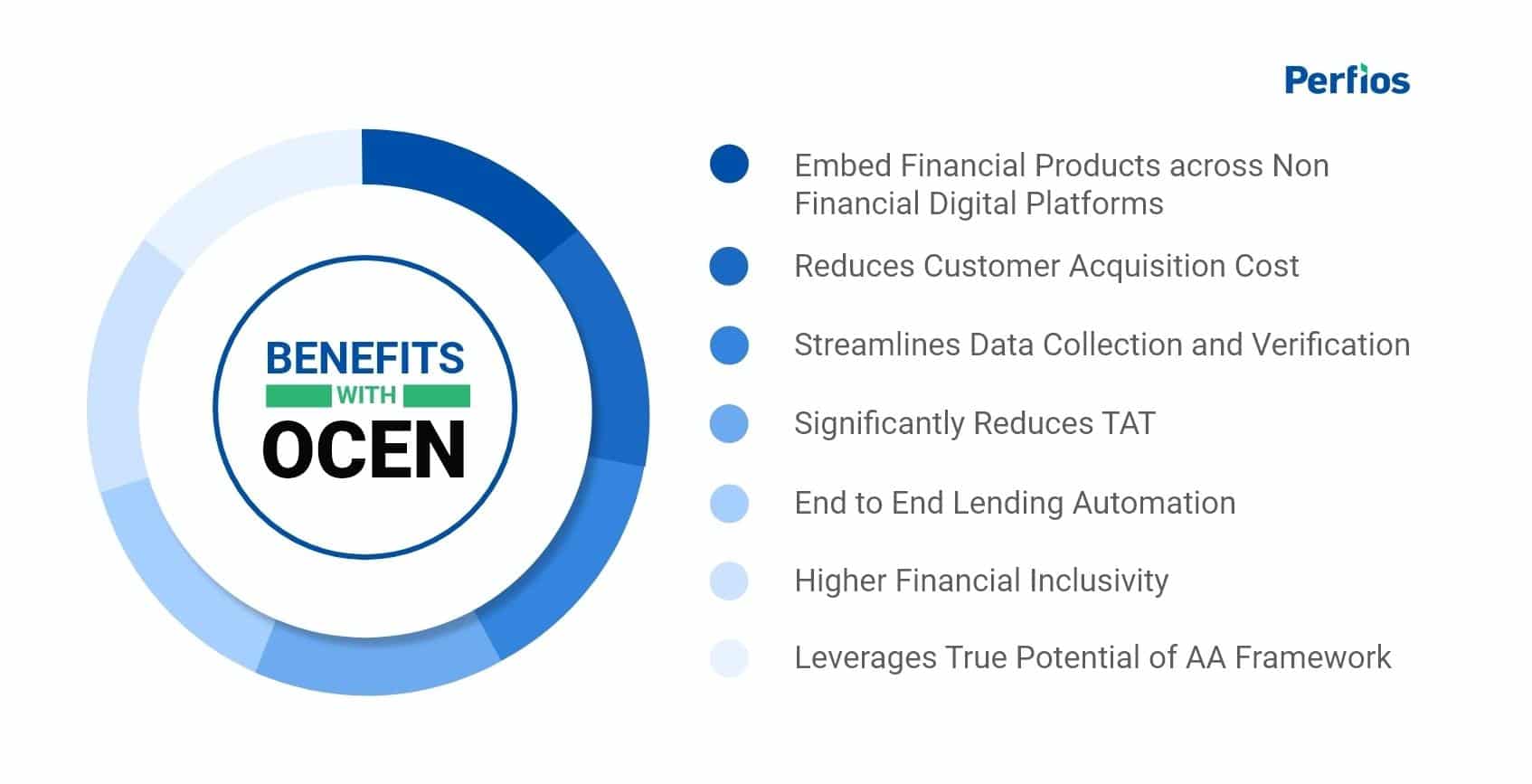

OCEN aims to address limited credit access in India by reducing customer acquisition costs and expediting loan disbursal. Its approach empowers borrowers, allowing them flexible access to funds and convenient repayment options. OCEN’s ability to sachet loans reaches remote areas, ensuring financial inclusion.

1. Customer Acquisition Cost:

OCEN reduces costs through its digital infrastructure, making credit accessible to a larger segment of the population, particularly the MSME sector; traditional systems have high operational costs, leading to elevated interest rates.

2. Data Collection and Verification:

OCEN simplifies data collection through digitization, ensuring accurate decision-making; traditional systems face challenges in collecting and verifying essential data as the process is often lengthy and involves a lot of paperwork.

3. Timeliness:

OCEN provides timely access to credit and the loan is credited as easily as with a tap of a few buttons, avoiding delays; traditional systems may have lengthy assessment processes, impacting borrowers’ financial health.

4. Role of Digital Platforms (LSPs):

Loan Service Providers (LSPs) can offer credit through OCEN’s framework which is layered on top of India’s ONDC platform, a bridge in the digital commerce value chain that ties borrowers, lenders, loan service providers, technology service providers, and account aggregators to expand their services; traditional systems had physical barriers to expand their reach which has been geared up by the interjection of OCEN’s digital platform.

5. Account Aggregators:

The GST Sahay pilot of India’s OCEN brought in Account Aggregators which helped in simplifying data sharing, and reducing paperwork; traditional systems involved manual operational processes which often led to inefficiencies as well as additional overhead costs.

6. Automation:

OCEN streamlined and digitized lending to the MSME sector through an API framework reducing complexity. OCEN’s efficiency challenges the status quo, making financial services more accessible and efficient in India.

7. Financial Inclusivity:

OCEN promotes inclusivity, making credit accessible to a wider range; traditional systems have limitations in reaching remote populations. Its standardized protocol fosters financial inclusion and innovation.

Role of Account Aggregators in OCEN

The GST Sahay pilot which was incrementally built on its GeM Sahay predecessor established the role of Account Aggregators as pivotal players in the OCEN ecosystem. Account Aggregators sought to tackle the problem of lengthy manual operational processes and inefficiencies by securely sharing data digitally and hence reducing paperwork. Borrower data is digitally accessible by Account Aggregators and it is presented in a machine-readable format, i.e. XML or JSON, which reduces the scope for error within the OCEN lending process.

Account aggregators play a transformative role in bridging the credit divide. By minimizing data manipulation risks for lenders, account aggregators ensure the accuracy and reliability of the shared data. The Account Aggregators streamlined roles within the OCEN framework by expediting loan disbursal & allowing borrowers to access credit in a timely manner whenever they need it.

By enabling seamless and secure data exchange between financial institutions, borrowers, and lenders, they create a friction-free environment via OCEN for lending. Borrowers no longer have to navigate through cumbersome paperwork and manual processes. Instead, they can rely on account aggregators to provide lenders with the necessary insights for accurate decision-making, ensuring timely access to much-needed funds.

In the evolving landscape of digital finance, account aggregators stand as the linchpin, revolutionizing the way data is shared and processed. Their role within OCEN signifies a shift towards efficiency, accuracy, and inclusivity. By simplifying data exchange, account aggregators pave the way for a more accessible and streamlined lending ecosystem, empowering businesses and individuals alike.

The Impact of Embedded Finance on OCEN

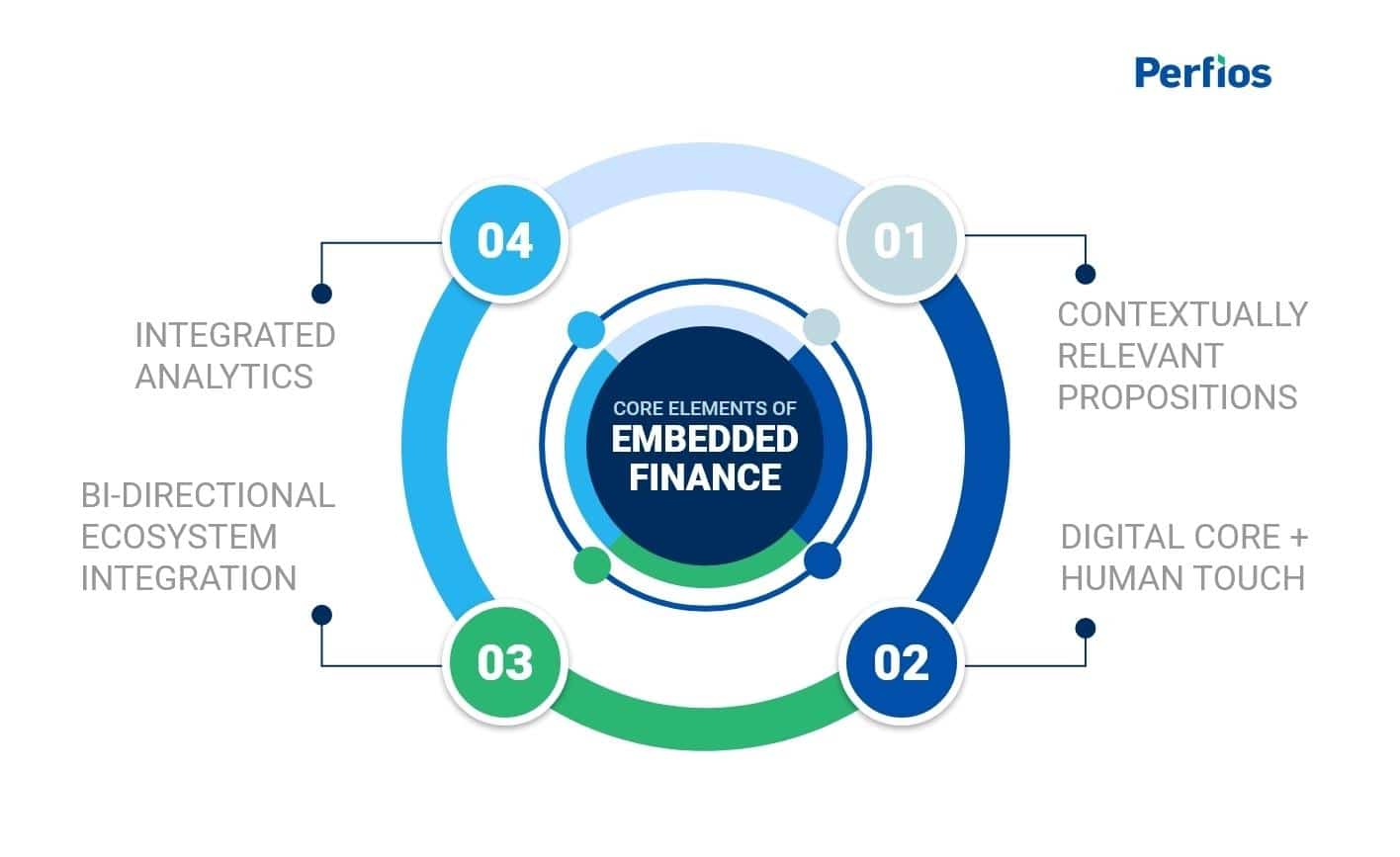

In today’s fast-paced world, where convenience is king, the concept of embedded finance (EmFi) is quietly reshaping the way we do business. Although many might not be familiar with the term, its influence is becoming increasingly pervasive. At its core, embedded finance enables non-financial entities to seamlessly integrate financial services into their platforms using Application Programming Interfaces (APIs). Imagine buying an iPad on Dipkart and effortlessly adding insurance without leaving the app – this seamless experience exemplifies embedded finance.

Embedded finance, particularly embedded lending in tandem with OCEN, is transforming the digital lending landscape, ushering in unparalleled financial inclusion. It allows non-financial entities to embed lending capabilities that were traditionally the domain of banks and NBFCs. The key innovation lies in APIs, which act as bridges, linking end-consumers and lending institutions.

The integration of lending capabilities into non-financial platforms offers a multitude of advantages. Unlike the conventional lending model, embedded lending drastically reduces the time required for the credit process. By digitizing the entire procedure, borrowers no longer need to approach lenders separately, significantly expediting the lending process. Moreover, for lenders, this model ensures better control over fund utilization aligning with OCEN’s objective of promoting T4 loans.

Embedded Finance and OCEN

In the context of India’s financial landscape, embedded finance aligns seamlessly with initiatives like the Open Credit Enablement Network (OCEN). By facilitating the integration of lending capabilities, OCEN empowers non-financial entities to act as intermediaries between consumers and lending institutions. This partnership not only streamlines the borrowing experience but also enhances financial accessibility, especially for underserved populations.

Crucially, Account Aggregators (AAs) play a pivotal role in ensuring the transparency and security of embedded finance. By securely managing data exchange, AAs provide lenders in the OCEN ecosystem with accurate insights, enhancing their understanding of borrowers’ financial behaviors. This transparency not only reduces risks but also fosters trust in the lending process.

Conclusion: Empowering Dreams, One Transaction at a Time

In the heart of India’s bustling markets and digital storefronts, a silent revolution is underway. The Open Credit Enablement System (OCEN), is not just a financial framework; it’s a promise fulfilled. It’s the story of Maya, the artisan whose dreams were once tethered by the limitations of accessible credit. OCEN changed her narrative, transforming her aspirations into reality.

Embedded within India’s Digital Public Infrastructure (DPI), OCEN isn’t just about loans; it’s about breaking barriers. Imagine Maya, navigating her small jewelry business in a bustling Indian marketplace. Thanks to OCEN, her journey is no longer restricted. The innovative integration of financial services through APIs has opened doors, enabling her to access funds seamlessly. OCEN is her partner, her supporter, reducing the complexities of lending into a tap, a click, a dream fulfilled…

In this narrative of transformation, Account Aggregators (AAs) play a vital role. They are the architects of trust, ensuring data security and transparency in every transaction. Embedded finance, entwined with OCEN is not just a concept; it’s a lifeline for Maya and countless entrepreneurs like her. It’s a testament to innovation, a blend of technology and empathy, redefining financial inclusivity.

As we envisage the future of Indian finance, it’s not merely about algorithms and codes; it’s about Maya’s smile when she expands her business. OCEN and embedded finance are the architects of this smile, the enablers of dreams. They stand as guardians of financial aspirations, promising a future where every entrepreneur, every individual, finds a path to success.

In closing, the story of OCEN and embedded finance isn’t just about revolutionizing the digital lending ecosystem; it’s about transforming lives. It’s about empowerment, innovation, and the unyielding spirit of entrepreneurship. Together, they are weaving a tapestry of financial opportunities, one transaction at a time, ensuring that dreams, regardless of their size, can soar high in the sky of possibilities.

About Perfios:

Perfios Software Solutions is India’s largest SaaS-based B2B fintech software company enabling 900+ FIs to take informed decisions in real-time. Headquartered in Mumbai, India, Perfios specializes in real-time credit decisioning, analytics, onboarding automation, due diligence, monitoring, litigation automation, and more.

Perfios’ core data platform has been built to aggregate and analyze both structured and unstructured data and provide vertical solutions combining both consented and public data for the BFSI space catering to their stringent Scale Performance, Security, and other SLA requirements.

You can write to us at connect@perfios.com

For more Such information contact us@ https://solutions.perfios.com/request-for-demo