The BFSI sector is undergoing a seismic shift, where customers demand the same level of sophistication, attention, and personalization from their banks as they experience in other industries. They are even willing to share their data (86%) to personalize their banking experience.

Nonetheless, the banking industry doesn’t evolve in isolation. It takes cues from the broader trends shaping various industries, including retail (with its tailored products), transport (ride-hailing services), hospitality (home-sharing platforms), and SaaS (with its granular segmentation capabilities) alongside advancements in FinTechs like Chime and OneCard.

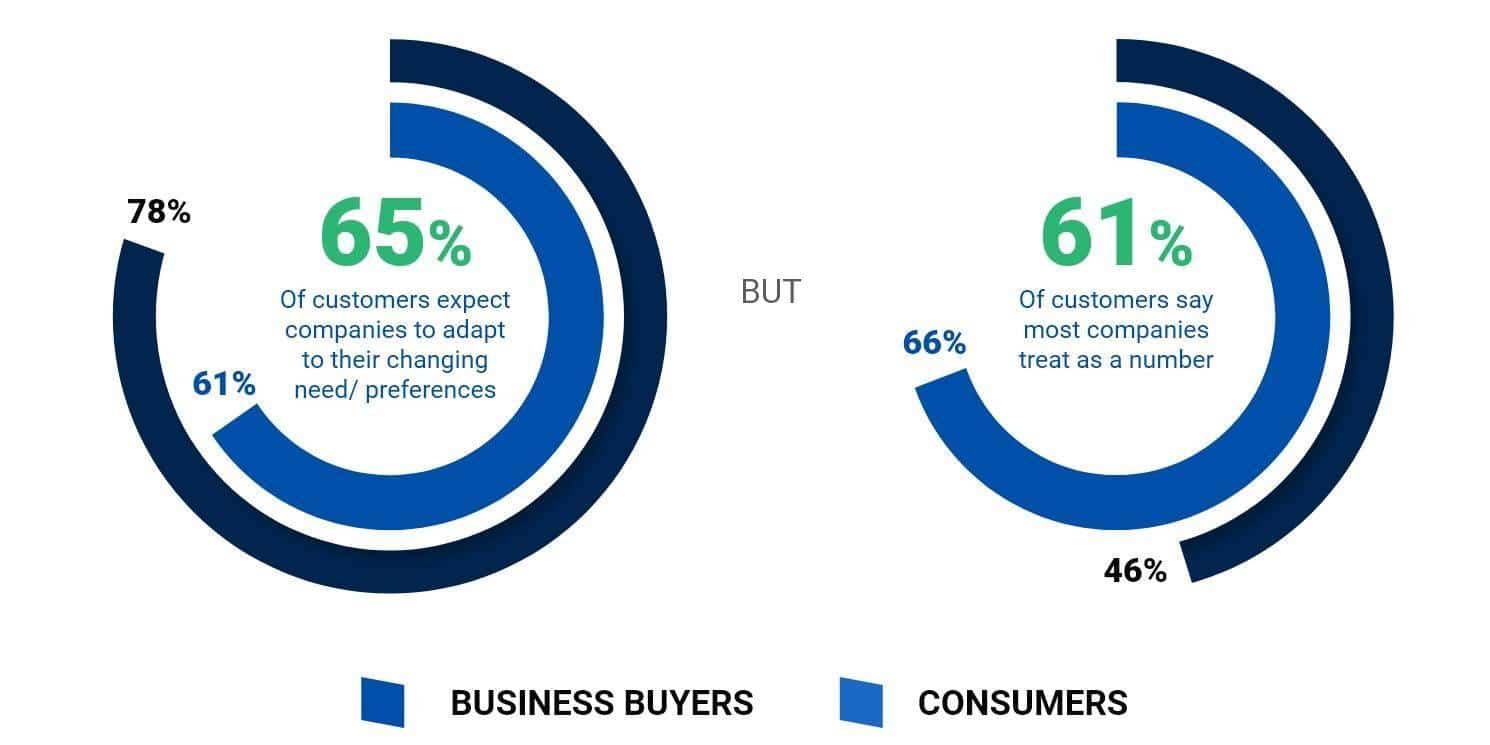

According to a Salesforce survey, 65% of consumers now expect companies to adapt to their needs and offer relevant services.

source- State of connected customer

This is where hyper-personalisation comes into picture.

Hyper-personlisation is the process of using machine-learning along with historical and real time data to tailor banking products and services to meet each customer’s specific needs.

To better understand how hyper-personalization can be helpful, let’s first take a look at the current situation of how banks engage with customers.

The current scenario

The banking world has seen a mix of progress when it comes to delivering more personalized interactions with customers. The majority of the banks have made strides by establishing communication channels within their netbanking and mobile banking apps. These channels are often integrated with their Customer Relationship Management (CRM) systems, allowing for the execution of marketing communications and campaigns.

Source – veripark

But there’s still a considerable distance to cover. Although nearly 90% have developed personas and behavioral segmentation, less than 30% systematically tailor communication variants for different customer personas.

A survey commissioned by Deloitte, featuring over 2,000 respondents, including both banked individuals and underbanked individuals, reveals that less than a third of respondents believe that their bank truly personalizes their products and services.

This further suggests that customers aspire to more than just streamlined journeys, live alerts, and apps with immersive features. They seek products and services that genuinely align with their unique needs.

When it comes to predictive algorithms, most bank CRMs still rely on monthly scored, perproduct propensity models. It means that the predictive indications both miss the most recent information (monthly scoring), and are generic in their outputs (which product, but not what communication).

According to a Mckinsey Study, mere 8% of banks are capable of applying predictive insights from their machine learning (ML) models to drive campaign execution and decision-making.

Almost all CRM data science teams have started to experiment with open-source technologies (Python/Spark), enabling them to build more powerful algorithms and process larger volumes of data per customer; this hasn’t yet been actively used in engagement or personalisation of services at least for the banking customers.

Another challenge for banks is transitioning away from manual campaign management. Current manual processes are time-consuming and marred by non-value-adding, repetitive tasks. These tasks involve the (semi-) manual generation of target groups, lead optimization, and lead distribution across various communication channels.

These challenges arise from legacy workflows, technology constraints, and, notably, a mindset rooted in manual targeting. In fact, only about 40% of banks have managed to minimize manual rework in their campaign cycle, all while still relying on outdated legacy technology.

Why hyper-personalization?

Remember the last time you opened your favorite streaming platform? Isn’t it incredible how you always see a carefully curated selection of films that match your taste perfectly? It’s like having a personal movie critic who knows you inside out, suggesting the ideal choices. That’s the magic of hyper-personalization in the entertainment world.

Now, let’s bring this concept to banking. Picture a bank that knows you as well as your favorite movie or music service. It uses real-time data and AI to tailor its offerings to your precise needs. Whether it’s recommending the right savings account, investment options, loan, or the right saving habits, it’s all about you.

And it doesn’t just stop there. It also taps into behavioral science to understand your motivations, perceptions, personality traits, values, and goals at a granular level. It’s like having a financial psychic who anticipates your needs, even the ones you didn’t know you had.

This is hyper-personalisation.

Research shows that 39% of customers abandon a website when faced with too many choices. But with hyper-personalization, that’s not the case. It narrows down the choices and shows you only what’s relevant to you. Think of it as having a personal shopper who handpicks items based on your style and preferences, making your shopping experience a breeze.

How does it work?

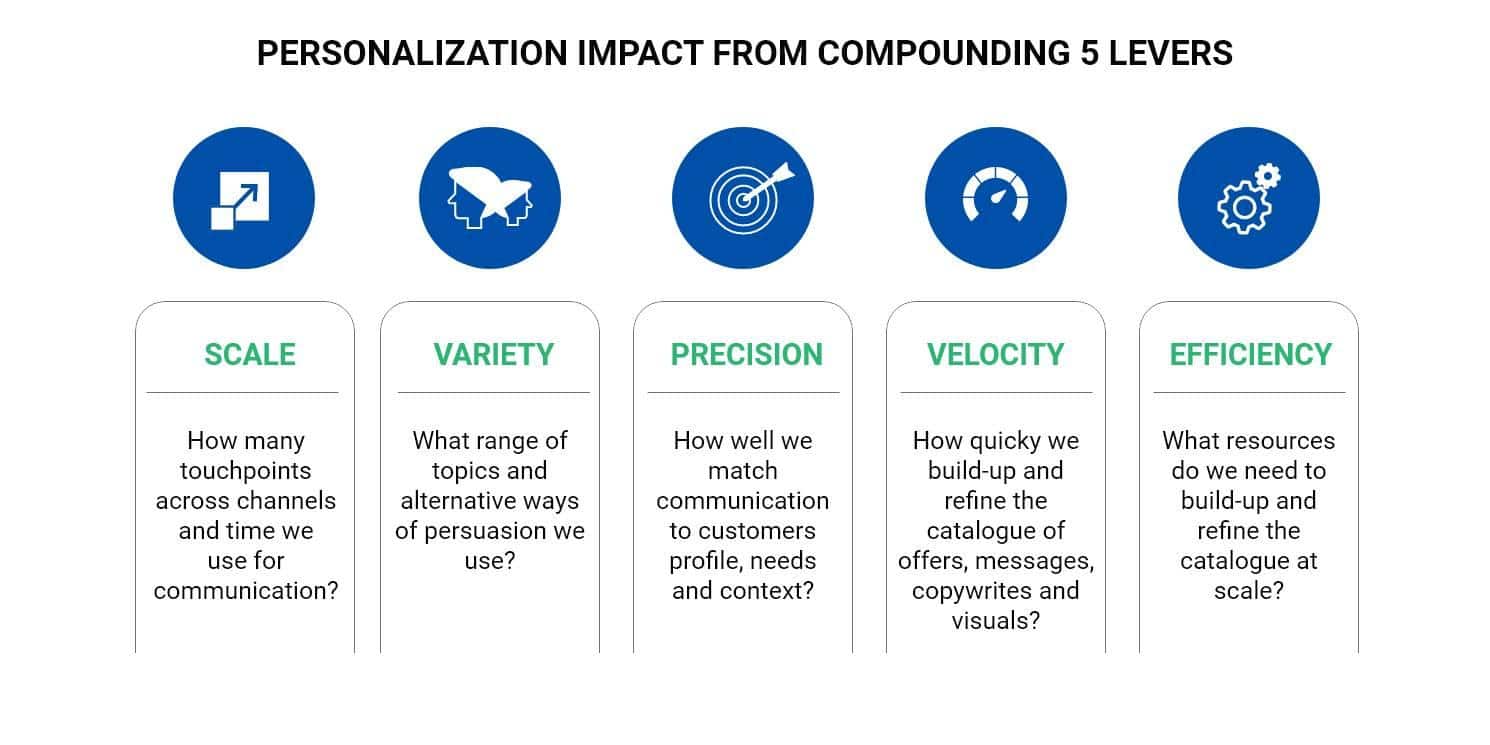

Hyper-personalization goes beyond adopting new technology or relying on off-the-shelf solutions. Leading banks have shown that successful transformation requires a strategic vision and a willingness to make substantial changes, not just in technology but also in mindset and operations. They integrate their personalization goals with their broader business strategies and follow a structured approach built on five essential levers for achieving impactful personalization: scale, variety, precision, velocity, and efficiency.

(Source: Just For You: The Route to Hyper-personalization in Banking)

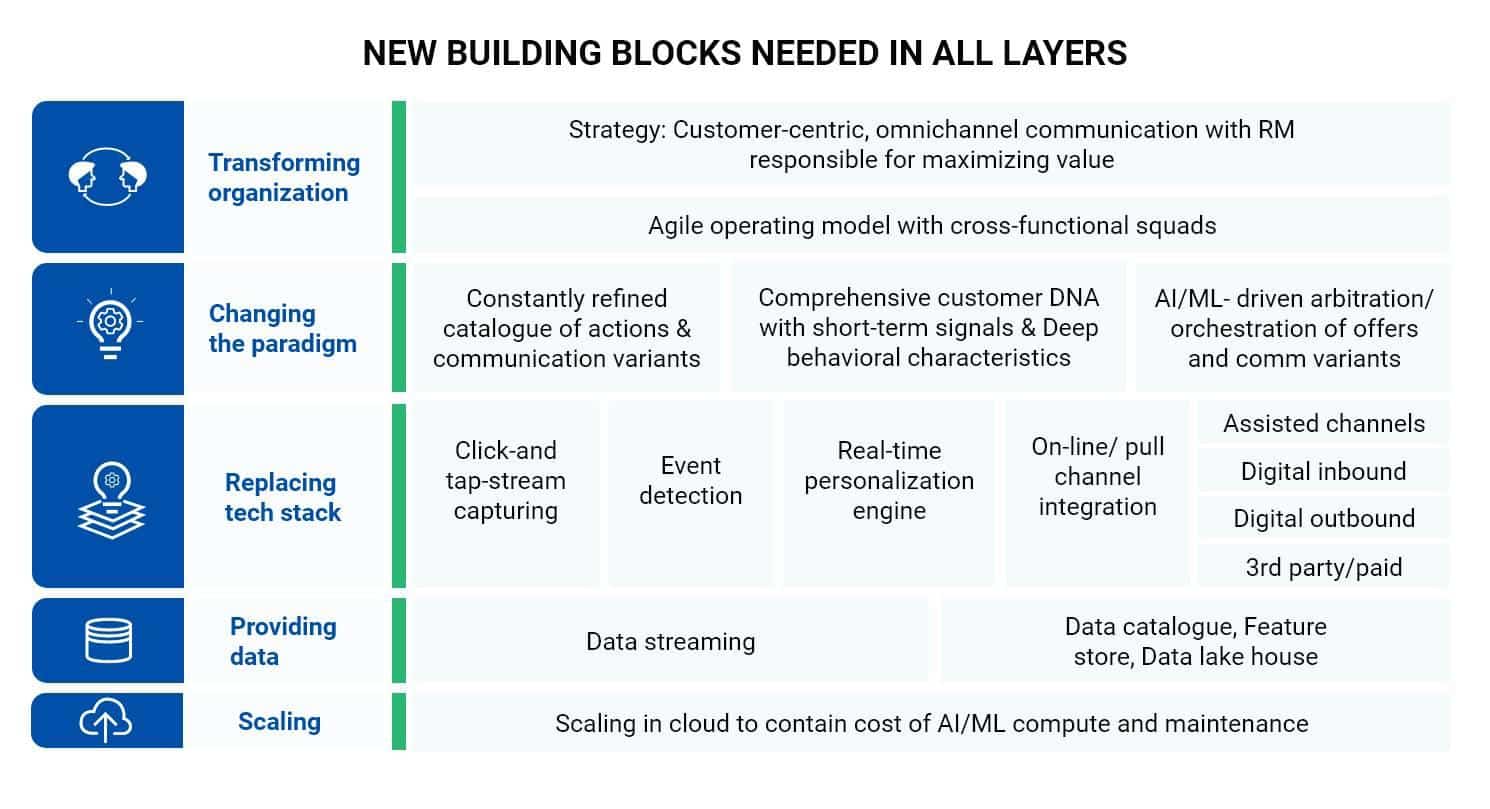

At the core of any hyper-personalization implementation is a well-defined vision of how it will operate and a deep understanding of the technology and operational model required. Advanced banks typically build their strategies on five fundamental building blocks

(Source: Just For You: The Route to Hyper-personalization in Banking)

The first of these building blocks hinges on the principle that meaningful change needs organizational commitment. Placing Customer Relationship Management (CRM) at the heart of value creation and establishing agile, cross-functional teams are pivotal components of this transition.

To enable this leap, some banks create integrated teams composed of multiple agile pods, each with a specific use case.

For example BIU or analytics teams in banks act as enabling pods that look at these insights and convert them into reusable assets and approaches.

The second building block involves diverse communication strategies, deep behavioral analysis, and advanced orchestration methods. Data science teams must adapt their approach to predictive models and take on more responsibility for overseeing communications and assessing their impact.

Creative teams need to focus on high-volume content production, seamlessly integrating AI/ML recommendations into their processes, and moving away from manual targeting. To streamline the mass production of content, close collaboration between marketing and compliance functions is crucial, ensuring both effectiveness and regulatory compliance.

To achieve positive business results, it’s important to start with the strategic framework that should be embedded into the technology platform. This crucial third building block includes key elements like capturing click and tap data, event detection, and making real-time decisions for both online and offline channels. Fourth and fifth blocks include advanced data streaming capabilities and the ability to expand use cases in the cloud, which are pivotal.

Once these five building blocks are in place or are thoroughly understood and planned, leading banks venture into the market to select the most suitable technology platform.

What and how can banks personalize?

The good news is that personalization in banking is achievable and many in the industry have started implementing it at scale, with fintechs leading the way.

To get you started, here are the 5 things you personalise for your customers

1. Customized product recommendations

Did you know that 90% of Indians had a bank account in 2020-21, and over a billion of them own smartphones with untapped potential? Surprisingly, most traditional banks miss the chance to engage effectively. Only 38% of banks have a robust data strategy, creating a significant opportunity for those ready to stand out.

Now, think about recommendation engines in banking—they’re like your personal shopping assistant for financial products. They answer questions like, “Which product suits the customer best?” or “Why should they go for it?” and even “Where should the offer appear, so it doesn’t come out as intrusive?

Recommendation engines, analyses customer’s financial information to create customer profiles based on spending patterns, industry benchmarks, and purchase categories. It uses these profiles to first understand customer needs and then recommend products that meet these needs.

2. Predict customer needs

Banks have a powerful tool at their disposal: advanced data analysis. This enables them to truly understand their customers and offer them tailored services, enhancing the overall banking experience.

Essentially, use the existing data to create customer profiles that they can use to predict the next customer requirement in real time.

Let’s say a customer has a savings account with a certain bank. Now, imagine if they could suggest a credit card that’s just right for you. How do they do it?

By diving into the spending patterns and using machine learning algorithms to predict what the customer might need in the future. It’s not just a time-saver; it’s like having a personal finance wizard guiding you toward smarter decisions.

3. Personalized promotional offers

Financial institutions are tapping into abundant data resources to precisely personalize promotional offers, strategically aligning them with the Customer Buying Cycle. An illustrative example is Santander’s Corporate and Investment Banking division in Poland, which developed an AI tool, Kairos. This tool predicts how a corporate client could be impacted by economic events, empowering employees to make more informed investment and lending decisions. Their ambition is to establish themselves as the “best open financial services platform,” customizing services to their employees, customers, shareholders and communities.

Furthermore, collaboration with fintech companies enables financial institutions to leverage customer loan data, even from competitors. ABN Amro in the Netherlands, in partnership with Subaio, is a noteworthy example. They curate a diverse array of highly converting personalized loan offers based on customers’ current payment data. Their knowledge extends to recurring payments, including existing loans and other financial products, leading to highly converting personalized loan options.

These are just a few examples illustrating the rising popularity of hyper-personalization in the banking sector, especially as digital banking becomes an integral part of our new normal.

What’s next for banks

Hyper-personalization is no longer a buzzword that tech guru’s are throwing around; it’s a reality in most other tech enabled businesses and a strategic necessity for banks. A study shows that 86% of customers are willing to share their data in exchange for a more personalized banking experience.

Out of the 86%, 36% are comfortable sharing their data with their bank exclusively, avoiding third parties. Another 26% are open to sharing their data if they receive clear explanations about how it will be used, and finally, 24% are entirely open to sharing their data with their bank without any reservations.

The customers themselves are calling for this transformation, and banks that embrace it swiftly will gain a substantial edge over their competitors. The recipe for success includes three key elements:

● Infrastructure Building Blocks: This involves harnessing data analytics, behavioral science, and ethnographic research capabilities.

● Product Functionality Innovation: Enhancing existing products and services is essential to meet the demands of personalized banking.

● Product Design Innovation: Building an emotional connection with customers is crucial.

Mastering these elements will not only set banks apart and boost their revenues but also reduce the risk of financial exclusion, making them responsible corporate citizens.

The bottom line

The journey toward making every customer interaction an opportunity for hyper-personalization starts with recognizing the existing gaps and setting a clear vision.

Taking a “start small and fail fast” approach is instrumental. This strategy allows the bank to establish a feedback loop, align efforts, and test hypotheses. Acting swiftly on this initiative and being a first mover can yield substantial advantages.

About Perfios:

Perfios Software Solutions is India’s largest SaaS-based B2B fintech software company enabling 1000+ FIs to take informed decisions in real-time. Headquartered in mumbai, India, Perfios specializes in real-time credit decisioning, analytics, onboarding automation, due diligence, monitoring, litigation automation, and more.

Perfios’ core data platform has been built to aggregate and analyze both structured and unstructured data and provide vertical solutions combining both consented and public data for the BFSI space catering to their stringent Scale Performance, Security, and other SLA requirements.

You can write to us at connect@perfios.com

For more Such information contact us@ https://solutions.perfios.com/request-for-demo