Introducing InteGREAT-Unified Branch Assist, a SaaS-based platform designed to revolutionize the onboarding and due diligence processes for Banks, NBFCs, and Fintechs. UBA empowers institutions to seamlessly automate their onboarding and underwriting tasks all within a single platform. This innovative platform ensures a swift, efficient, and accurate completion of Digital Due Diligence, offering a comprehensive suite of features that include targeted lead capture, out-of-the-box API integrations, verification measures, KYC, document aggregation and analysis, and more…

Unified Branch Assist enables users to perform all necessary activities within a unified platform, seamlessly integrating with LOS/LMS systems for a cohesive experience. Moreover, the platform is easily configurable with a record-breaking GTM and is being improved iteratively leveraging user feedback for a better experience.

Blog Highlights:

● Due diligence, a regulatory necessity, is crucial for a sound lending cycle. UBA has become a key player in simplifying this process.

● UBA is more than just a tool; it’s a practical solution that is easily configurable. It aids credit managers, DSAs, and personnel in conducting due diligence checks efficiently.

● UBA stands out with its versatility, going beyond KYC checks. It supports authentication for various documents, making it a one-stop solution.

● The platform doesn’t just stop at due diligence; it’s designed for efficiency. It reduces Turn Around Time (TAT) for credit personnel by consolidating checks.

● UBA’s bank statement analysis feature and CAM reports simplify decision-making, providing an authentic and comprehensive view for lenders.

The Crucial Role of Due Diligence

At the core of an FI’s daily operations within the money market lies due diligence, an indispensable process mandated by the Reserve Bank of India (RBI). As regulated entities, credit lending institutions must meticulously adhere to due diligence checks when evaluating credit requests. This due diligence process serves as the linchpin in the lending cycle, laying the groundwork for onboarding customers onto the Financial Institution’s books.

RBI, within its regulatory framework, outlines stringent protocols for due diligence, underscoring the need for sophisticated tools and platforms to ensure compliance. This is precisely where the Unified Branch Assist (UBA) platform emerges as a crucial ally to help maintain protocols.

The Dynamics of Unified Branch Assist (UBA) Platform

Unified Branch Assist, or UBA, is not just a nondescript platform but a transformative Business-to-Business (B2B) interface. Its primary mission is to facilitate credit underwriting decision-making for credit managers, Direct Selling Agents (DSAs), and credit personnel. Beyond its facilitative role, UBA is a mainstay in conducting pre-lending due diligence checks, contributing to the maintenance of a robust loan book while minimizing redundancies.

The Unified Branch Assist (UBA) platform is equipped to perform advanced tasks like bank statement analysis and curate singular cross-analysis reports to verify the authenticity of statements & provide a comprehensive analysis. Pre-integrated with in-house Perfios products like the Bank Statement Analysis feature & CAM, UBA empowers lenders to make informed decisions, making it a star product.

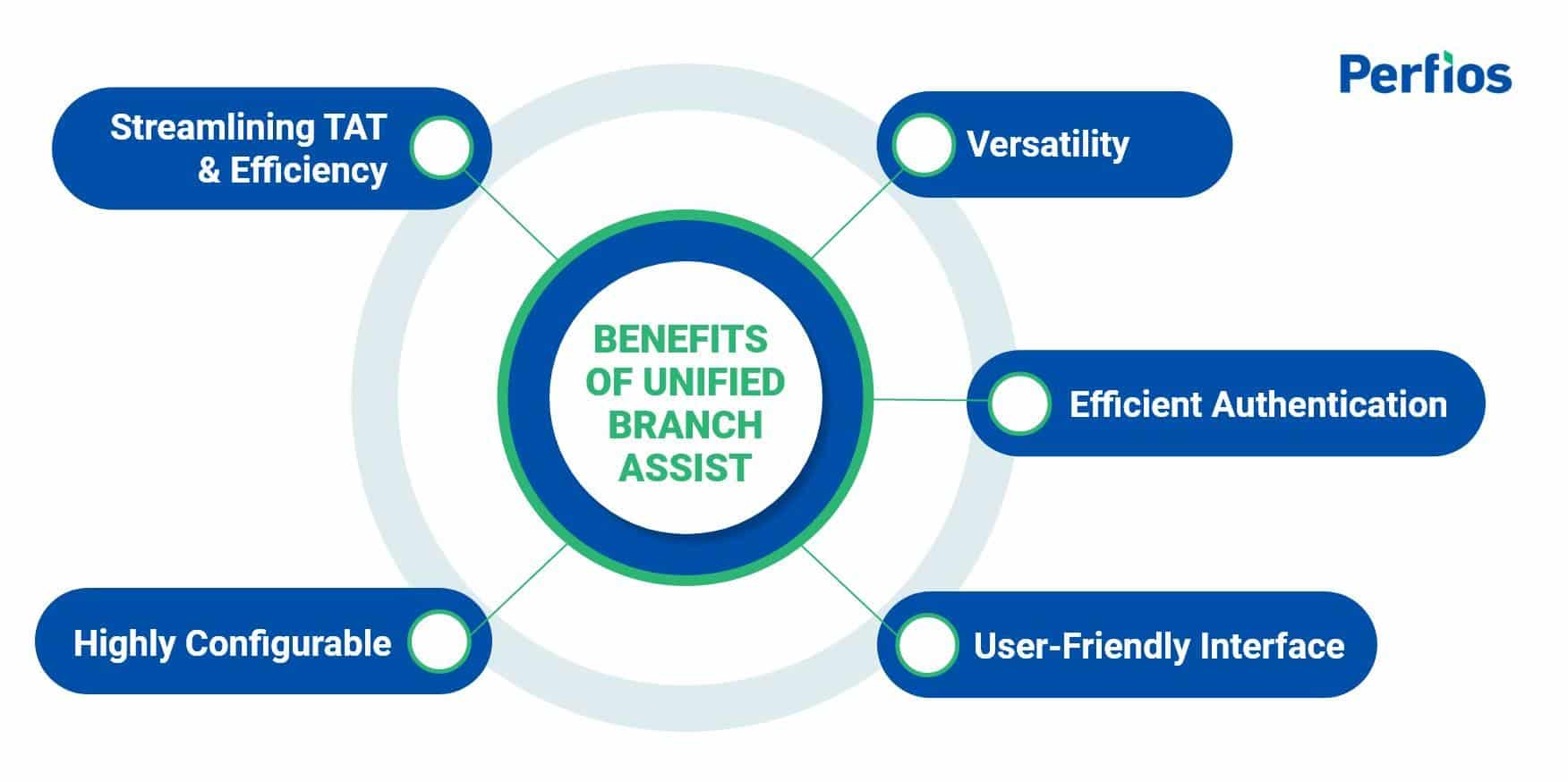

Diving Deeper into UBA’s Benefits:

– Versatility: UBA stands out as a versatile tool catering to the diverse needs of banks, NBFCs, and emerging fintech players. It goes beyond the conventional Know Your Customer (KYC) checks, encompassing various risk management steps.

– Efficient Authentication: The platform supports authentication processes for bank statements, Income Tax Returns (ITRs), Goods and Services Tax (GST), Financial statements of entities, Credit Bureau reports and more. It spans the entire spectrum of KYC checks, supporting Video Personal Discussions, Video KYC, e-verification (address), KScan (corporate entity verification and analysis), and E-Sign, among other functionalities.

– Highly Configurable: UBA is designed to be effortlessly configurable according to client requirements, consolidating pre-sanction Loan Origination System (LOS) functionalities in one accessible place.

– User-Friendly Interface: Users, including Customer Relationship Managers, loan executives, or any personnel dealing with borrowers, find efficiency in capturing required documents and information on the UBA platform.

– Streamlining TAT & Efficiency: With Financial Institutions (FIs) greatly suffering from discussions in reducing TAT while not compromising on their due diligence processes, it became an opportunity for us to address this issue while getting on the drawing boards to make something of a product which not only helps our clients in their endeavor. By centralizing all pre-requirement checks under one roof, the platform enhances efficiency and effectiveness.

Forging Ahead with Value Creation

In the bustling realm of financial services, the ability to create value serves as a unique selling point, distinguishing products based on their pragmatism and impact. At Perfios, our daily mission revolves around enriching financial processes. We continually question our methods, probing into what we do, how we do it, and, most importantly, why we do it.

The product is actively being utilized by 25 FIs (and counting) in their decisioning processes, the Unified Branch Assist Portal has received positive feedback and multiple accolades. As the macro scenario evolves, our commitment remains unwavering – we listen to our clients, incorporate their feedback, and introduce new features to the Business Analytics Platform (BAP), thereby exceeding our clients’ expectations and solidifying trust in our work.

Read more@ https://www.perfios.com/post/fraud-risk-101-understanding-and-safeguarding-against-financial-threats

About Perfios:

Perfios Software Solutions is India’s largest SaaS-based B2B fintech software company enabling 1000+ FIs to take informed decisions in real-time. Headquartered in mumbai, India, Perfios specializes in real-time credit decisioning, analytics, onboarding automation, due diligence, monitoring, litigation automation, and more.

Perfios’ core data platform has been built to aggregate and analyze both structured and unstructured data and provide vertical solutions combining both consented and public data for the BFSI space catering to their stringent Scale Performance, Security, and other SLA requirements.

You can write to us at connect@perfios.com

For more Such information contact us@ https://solutions.perfios.com/request-for-demo