Objective

● Highlighting the need for pre-issuance verification call (PIVC) in India

● Immersive dive into pre-issuance verification call (PIVC) and what it is all about.

● Why is pre-issuance verification call the need of the hour?

● Comparative analysis of the best features of pre-issuance verification solutions in the industry

● Perfios PIVC 2.0 – A newly launched DIY journey

Introduction

From the bustling lanes of Mumbai to the tranquil locales of Kerala, insurance has woven itself into the financial tapestry of many families. The insurance penetration in India has notably risen from 2.7% in 2000 to 4.2% in 2021, primarily driven by the pandemic which heightened awareness and the demand for protection, especially health insurance.

As of 2023, the insurance market continues to rebound post-pandemic, with general and life insurance markets growing at 16% and 18% respectively compared to the previous year. The bifurcation between life and non-life (or general) insurance is clear, with life insurance penetration standing at 3.2% and non-life insurance at 1%.

In this vast and diverse insurance landscape, ensuring accurate information dissemination is imperative. Enter the realm of Pre-Issuance Verification Call (PIVC).

Much like a verification call post an online purchase, PIVC is an integral step in the insurance buying process. Instituted by some life insurers in compliance with the IRDAI (Insurance Regulatory and Development Authority of India) regulations, PIVC aims to ensure that the insurance proposal aligns with the customer’s needs before policy issuance.

This step not only curtails misinformation but also aids in identifying the apt insurance product for the customer, fostering a transparent and honest inception to the insurance journey.

Thus, whether you’re a seasoned insurance aficionado or a newcomer to this domain, understanding the nuances of PIVC can be a valuable addition to your insurance literacy, fostering a culture of clear communication in India’s ever-evolving insurance arena.

What is Pre-Issuance Verification Call (PIVC)?

Ever shopped online and got a call or text double-checking your order? Or maybe you’ve tried for a job and they called up your old boss to see if you’re legit?

That’s all about making sure the info you gave is right. In the insurance world, this double-check is called the Pre Insurance Verification Call, or PIVC for short.

When you decide to get insurance, you’re essentially entering into a contract. This contract is based on the information you provide, and any discrepancies can lead to complications down the line. Imagine needing to use your insurance only to find out there’s an issue because of some miscommunication or oversight. That’s where PIVC comes in.

In India, over 62% of insurance disputes arise due to discrepancies in policy details. PIVC acts as a preventive measure, ensuring that both the policyholder and the insurance company are on the same page. It’s a verification call to cross-check the information you’ve provided. Think of it as a quality check for your insurance application.

Now, you might wonder if this is unique to India. The answer is no. Globally, verification processes are a standard practice across various sectors.

For instance, banks worldwide often verify employment and financial stability before approving loans. Similarly, in countries like the US and UK, background checks are common when renting properties.

However, what sets PIVC apart is its specialization for the insurance sector. While the core principle of verification remains consistent, PIVC is tailored to address the nuances of insurance policies.

Why Does an Insurance Company Do Pre-Issuance Verification Call?

In the intricate tapestry of the insurance sector, the Pre Insurance Verification Call (PIVC) stands out as a golden thread, weaving together a fabric of trust, authenticity, and security.

While the primary role of PIVC is to verify information, its benefits extend far beyond mere confirmation. Let’s delve into the multifaceted advantages of this pivotal process.

Risk Management: A Proactive Approach

Every insurance policy is essentially a calculated risk. Insurers assess the likelihood of an event occurring and determine the premiums and coverage accordingly.

But for this calculation to be accurate, the information provided by policyholders needs to be spot-on. Here’s where PIVC shines.

By meticulously verifying every detail, PIVC helps insurers get a clearer picture of the risk involved. For instance, confirming a policyholder’s medical history can provide insights into potential health risks.

Similarly, verifying details about a vehicle’s condition and usage can help assess risks in motor insurance. By identifying and understanding these risks upfront, insurers can tailor policies more effectively, ensuring that both the company and the policyholder are on firm footing.

Fraud Prevention: A Shield Against Deception

From exaggerated claims to fabricated documents, fraudulent activities are a pressing concern for the insurance sector. The financial repercussions are significant, but there’s also the added challenge of maintaining credibility in the eyes of genuine policyholders.

Enter PIVC, the industry’s vigilant sentinel. By cross-checking information and ensuring that every detail aligns with the facts, PIVC acts as a robust barrier against fraud. It’s not just about catching discrepancies; it’s about preempting potential fraudulent activities before they take root.

With PIVC in place, insurers can confidently issue policies, knowing that they’re backed by genuine and accurate information.

Customer Trust: Building Bridges with Transparency

Trust is the cornerstone of any lasting relationship, and the bond between insurers and policyholders is no exception. But how do you foster this trust? The answer lies in transparency and authenticity, two values championed by PIVC.

When policyholders know that their information is being verified, it sends a clear message: the insurance company values accuracy and is committed to offering a policy that truly aligns with the individual’s needs.

This transparency, coupled with the assurance that the policy is based on genuine information, bolsters confidence among policyholders. It’s a mutual understanding, a shared commitment to authenticity, and a promise of a relationship built on solid ground.

Challenges and Solutions in the PIVC Process

The Pre Insurance Verification Call (PIVC) is undeniably a game-changer in the insurance sector, ensuring accuracy and building trust. However, like any process, it comes with its own set of challenges.

But fret not, for where there are challenges, there are also innovative solutions. Let’s explore the hurdles in the PIVC journey and the ingenious ways the industry is navigating them.

Communication Barriers: Bridging the Gap

● Challenge: India is a land of diversity, and this extends to languages as well. With policyholders spread across different regions, speaking a myriad of languages, communication can sometimes become a challenge during the PIVC process.

● Solution: Many insurance companies now offer multi-lingual support, ensuring that the PIVC is conducted in a language that the policyholder is comfortable with. Advanced systems are in place to detect the preferred language based on the policyholder’s location, ensuring a smooth and efficient verification process.

Incomplete Information: Filling in the Blanks

● Challenge: At times, policyholders might inadvertently miss out on providing certain details in their application. This incomplete information can pose a challenge during the verification process, leading to delays and potential discrepancies.

● Solution: Insurance companies have adopted a proactive approach. Instead of outright rejecting applications with missing details, representatives are trained to guide policyholders during the PIVC, helping them understand what’s missing and assisting them in providing the necessary information. This not only speeds up the process but also enhances the customer experience.

Technological Hurdles: Embracing Digital Solutions

● Challenge: In this digital age, technology plays a pivotal role in the PIVC process. However, issues like poor connectivity, especially in remote areas, can hinder the verification call.

● Solution: Recognizing this challenge, insurance companies have invested in advanced systems that can function seamlessly even with low bandwidth. Additionally, there’s an option for policyholders to schedule the PIVC at a time when they have stable connectivity, ensuring that the process is uninterrupted.

Ensuring Authenticity: Guarding Against Misrepresentation

● Challenge: While most policyholders provide genuine information, there’s always a risk of misrepresentation, either unintentionally due to misunderstanding or intentionally to secure better policy terms.

● Solution: To combat this, insurance companies have introduced rigorous training programs for their representatives, equipping them with the skills to detect inconsistencies and ask the right questions. Additionally, with the integration of advanced AI and data analytics, patterns of misrepresentation can be identified, further fortifying the verification process.

Benefits of PIVC for the Insurance Sector

The insurance sector, a cornerstone of the financial industry, has always been reliant on trust, credibility, and efficiency. With the advent of technology and the increasing demand for streamlined processes, the sector has been undergoing significant transformations.

One such innovation that has been making waves is the Paperless Insurance Video Claim (PIVC). Here’s how PIVC contributes to the overall health and credibility of the insurance sector:

Enhancing Customer Experience

PIVC offers a seamless and efficient claim process for customers. Instead of navigating through heaps of paperwork and waiting for prolonged periods, customers can now initiate and complete their claims through a video-based process. This not only speeds up the claim settlement but also enhances the overall customer experience.

Reducing Fraudulent Claims

One of the primary concerns for insurance companies has always been fraudulent claims. PIVC, with its video-based evidence system, acts as a deterrent for such activities. It’s harder to fake a claim when there’s video evidence, leading to a reduction in fraudulent activities.

Cost Efficiency

The traditional claim process involves multiple steps, manual verification, and often physical inspections. PIVC eliminates many of these steps, leading to significant cost savings for insurance companies.

The Role of Regulatory Bodies

In India, the Insurance Regulatory and Development Authority of India (IRDAI) has set forth guidelines for the implementation of Personal Identity Verification Credentials (PIVC) with the aim of safeguarding policyholders’ interests.

On a similar note, countries in Southeastern Asia have been making strides towards digital adoption in the insurance sector, a shift accelerated by the COVID-19 pandemic, which has nudged consumers towards digital platforms for insurance among other services.

Notable efforts towards digital identity implementation have been seen in the Philippines, with a substantial project initiated in 2018, dedicating 30 billion pesos (US$563 million) for the creation of a digital ID. Singapore, too, has been at the forefront, developing Singpass, its national digital identity, to enhance the lives of its citizens and open up business opportunities.

Insurers across Southeastern Asia are not only embracing digital transformation to improve customer engagement but are also exploring innovative approaches to drive the insurance sector forward.

This transformation is hoped to change the traditional operational models, making way for sustainable health products and services. Furthermore, trust has emerged as a central theme in the deployment of digital IDs for financial applications in the region.

The integrity of service providers is increasingly being seen as a crucial factor, highlighting the importance of trust in the successful implementation and acceptance of digital identity verification systems across the financial and insurance sectors in Southeastern Asia.

Perfios: Revolutionizing PIVC with Technology

Agreements serve as the bedrock of the relationship between the insurer and the customer. These agreements not only define the terms and conditions but also set the expectations for both parties. Ensuring clarity and mutual understanding in these agreements is paramount to foster trust and prevent future disputes.

The Need for a Do-It-Yourself PIVC Journey:

Historically, policy-related disagreements have been a significant pain point in the insurance sector. These disagreements often arise from ambiguities in policy terms or miscommunication between the insurer and the customer.

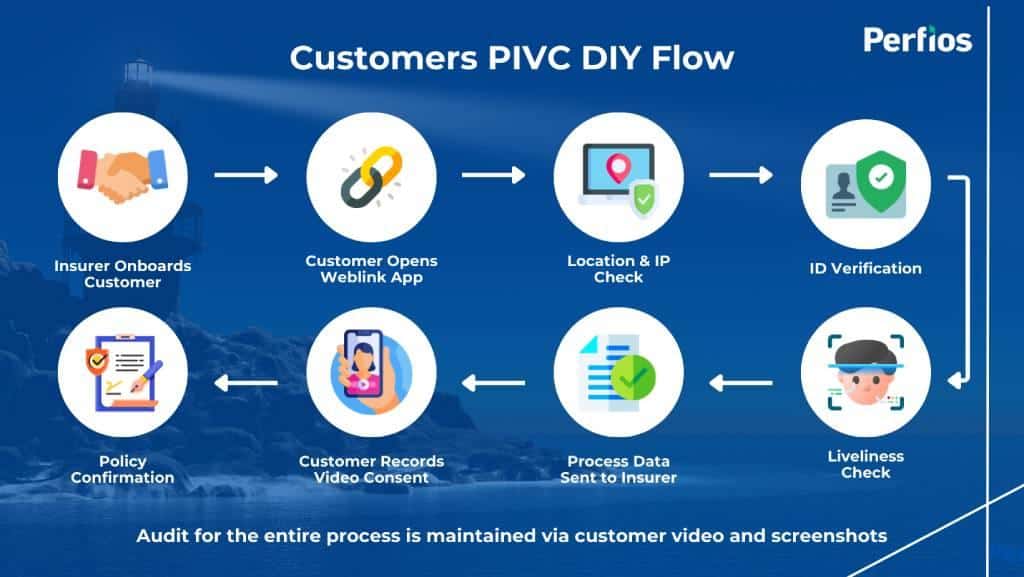

Recognizing this challenge, Perfios introduced PIVC 2.0, a cutting-edge solution designed to streamline and enhance the policy verification and agreement process.

Features of Perfios PIVC 2.0 – A DIY Journey

● Speech-to-Text Verification: Leveraging advanced speech recognition technology, PIVC 2.0 can convert spoken words into text, ensuring that all verbal agreements are accurately documented.

● Lightning-Fast Consent: With real-time processing capabilities, PIVC 2.0 facilitates instant consent, eliminating delays and enhancing customer experience.

● Global Language Support: Catering to a diverse clientele, PIVC 2.0 supports multiple languages, ensuring that customers across the globe can understand and agree to policy terms in their native language.

● Location and IP Fraud Check: To prevent fraudulent activities, PIVC 2.0 incorporates location and IP checks, ensuring that the policy agreement is genuine and not manipulated.

● Minimal Bandwidth Requirement: Designed for efficiency, PIVC 2.0 operates seamlessly even with limited internet bandwidth, making it accessible to users in areas with poor connectivity.

● Uncompromising Security: Prioritizing data protection, PIVC 2.0 employs state-of-the-art encryption and security protocols to safeguard sensitive information.Cloud-Powered Scalability: Hosted on the cloud, PIVC 2.0 offers unparalleled scalability, ensuring that insurers can cater to a growing customer base without any hitches.

● Accurate Verification: With advanced algorithms and verification processes, PIVC 2.0 ensures that all policy details are accurately captured and verified, minimizing the chances of future disputes.

The introduction of Perfios PIVC 2.0 – DIY Journey marks a significant milestone in the evolution of insurer-customer agreements. By leveraging technology, Perfios is not only addressing the existing challenges in the sector but also paving the way for a future where policy agreements are transparent, efficient, and dispute-free.

The Future of PIVC

The insurance sector, like many other industries, is undergoing a digital transformation. With the rise of digital platforms and AI-driven processes, the future of Pre Insurance Verification Call (PIVC) is poised for significant evolution.

As technology continues to advance, we can expect PIVC processes to become more streamlined and efficient. The integration of AI and machine learning can automate many aspects of the verification process, reducing human error and ensuring more accurate results.

Also, while PIVC is a crucial aspect of the insurance sector in India, similar verification processes are being adopted globally. The international insurance market is leaning towards real-time verification methods, utilizing advanced technologies to ensure the authenticity of information provided by policyholders.

The insurance sector in India is rapidly evolving, with new products, services, and regulations being introduced. PIVC will need to adapt to these changes, ensuring that it remains relevant and effective in verifying policyholder details. With the integration of technology, policyholders can expect a smoother and more user-friendly PIVC experience.

Automated systems, instant verifications, and real-time updates will enhance the overall customer experience, making the process less cumbersome and more efficient.

Drop a note here if you want a complete demo of the Perfios PIVC 2.0 solution

About Perfios:

Perfios Software Solutions is India’s largest SaaS-based B2B fintech software company enabling 900+ FIs to take informed decisions in real-time. Headquartered in mumbai, India, Perfios specializes in real-time credit decisioning, analytics, onboarding automation, due diligence, monitoring, litigation automation, and more.

Perfios’ core data platform has been built to aggregate and analyze both structured and unstructured data and provide vertical solutions combining both consented and public data for the BFSI space catering to their stringent Scale Performance, Security, and other SLA requirements.

You can write to us at connect@perfios.com