Everyone has been talking digital, something Financial Institutions wanted to do but in the foreseeable future. The pandemic changed this for everyone and brought it to the forefront. It has become the hot topic in most webinars and events today and we now accept that this change is irreversible . The flip side of jumping on the digital bandwagon is trying to get there too quickly and not recognizing the nuances that come with it.

There has been an increased intertwining of fraudulent and concerning digital activities in the recent past. Our study on the potential fraud attempts for availing credit from Banks, NBFCs and Fintechs reveals a concerning increase in the trends of unauthorised / illicit digital activities and tweaking of the banking data. Banks, NBFCs, and Fintechs have seen this spurt across their digital and phygital* journeys. We are also seeing an increasing trend in the number of financial documents that have been tampered and there was a definite spike in April’20 to June’20.

RBI’s recent response to an RTI vindicates the rise in frauds in FY20. One can see aspiration all around – to get going, get back into business, overcome the pandemic, to survive and thrive and as they say the probability of fraud could stay high in cases where aspiration gives way to desperation.

Perfios Fraud Check Unit(FCU) equips a lending institution with the following capabilities:

• Document Authenticity Check

• Transactional / Behavioural Triggers

With millions of statements processed every month by Perfios Bank Statement Analyzer Solution Suite, Perfios FCU Engine continues to adapt and improvise intelligently each day thereby guarding our customers interest against fraudulent bank statements. With minimal system level changes we enable our clients to be future ready, protect themselves against imminent fraud and improve the quality of their book.

Perfios Fraud Check Unit (FCU) and what it offers?

FCU will help lenders to identify if various types of financial statements (such as banks, credit cards, ITR etc.,) submitted by the borrower are potentially tampered or not. (Document Authenticity Check)

Perfios Fraud Check also has a large library of behaviour fraud triggers that has been developed to address credit assessment risk. The Fraud triggers are used in decisioning and bucketing of applications as GREEN, AMBER and RED channel and this allows FIs achieve significant customer delight in instantaneous approval and at the same time mitigate risk of the intentional fraudster abusing digital channels.

Perfios is expanding its Fraud Analytics product line to include a library of Fraud triggers that computes “Truth Value” based on data validation across multiple documents submitted by the applicant.

Frequently asked Questions:

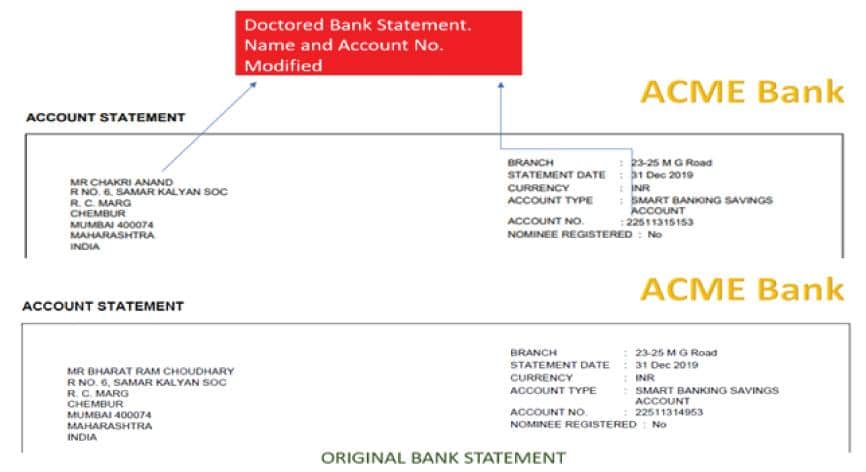

Q: How does Perfios FCU check the authenticity of the statement?

A: Authenticity of original e-statements is checked on the digital footprint of the document and other digital footprint checks. These checks serve as inputs for FIs Risk team to identify potential fraudulent activity.

Fig 1. Sample Document Tampering

Q: What all documents can be verified by Perfios FCU?

A: Authenticity checks can be done for the following type of documents:

•Bank e-statements

• Income Tax Return e-statements – ITR Forms 1-6, ITR-V and Form 26AS

• GSTR e-statements

Q: Can the authenticity check be done for scanned statements?

A: Document authenticity check cannot be done for a scanned statement as it is an image with no reliable digital footprints of the documents.

Q: Can the behavioral fraud triggers be generated from eStatement and Scanned statement.?

A: We have triggers to identify abnormal transaction level behaviours. Some of these triggers can be consumed by the credit team, some by risk. Perfios can help you pick these triggers.

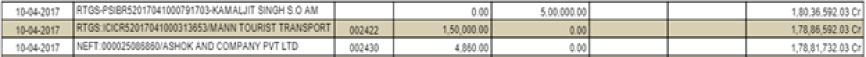

Fig 2. Transactional Fraud in the Bank Statement (RTGS Amount < 2L)

Q: What does it take to get started?

A: Getting onboarded with Perfios e-Statement(s) Analyser and respective FCU engines without any additional integration effort.

To our customers using the Fraud Check Utility, we thank you for your trust and confidence. To know more about Perfios Fraud Check Unit(FCU), click here.

*Phygital – concept of using technology to bridge the gap between the digital world and physical world to provide better user experience.