Aadhaar, India’s biometric ID system, stands as a cornerstone of technological innovation in an era where digital identity is paramount.

In March 2023 alone, Aadhaar holders executed an astonishing 2.31 billion authentication transactions, a testament to the system’s widespread acceptance and integral role in India’s burgeoning digital economy.

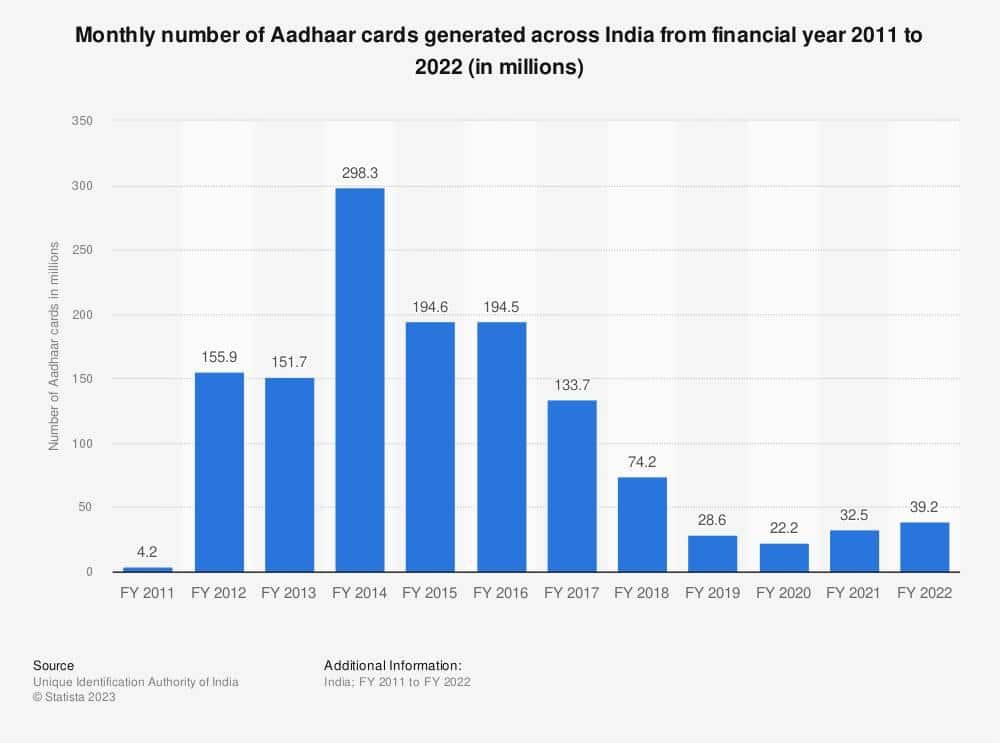

This figure is a mere snapshot of Aadhaar’s extensive reach; as of 2022, approximately 39.2 million new Aadhaar identification cards were generated, reflecting its ongoing expansion and relevance.

Remarkably, Aadhaar has achieved near-universal coverage in India, with 99.7% of the adult population enrolled, illustrating its crucial role in the nation’s socio-economic fabric.

Furthermore, Aadhaar is not just a mere identity document; it is a key enabler in accessing over 400 central and 300 state government schemes, thus underscoring its significance in India’s governance and public service delivery.

In this context, the Aadhaar Verification API emerges as a pivotal tool, harnessing the power of this extensive network to streamline verification processes, like Onboarding KYC, Age-Gating, Due Diligence, etc.

This blog delves into the nuances of Aadhaar Verification API, exploring its role in KYC verification, its usage, and the benefits it brings to the table.

We will also be sharing key insights into Perfios’s Aadhaar Verification API, a solution in this domain, demonstrating how it seamlessly integrates into and enhances the Aadhaar ecosystem.

What is Aadhaar Verification API?

Aadhaar Verification API addresses this crucial need, particularly against the backdrop of increasing identity thefts and cybercrime. It enables verification using Aadhaar – a unique 12-digit identification number linked to an individual’s biometric data, such as fingerprints, facial, and iris scans, issued by the Indian government.

This verification is a key component of the Know Your Customer (KYC) process, designed to mitigate identity fraud risks and eliminate duplicate or fake identities.

Aadhaar verification is extensively employed across various sectors like banking, telecommunications, government services, e-commerce, and logistics. It is integral to processes such as onboarding employees, engaging third parties, or forming business partnerships.

Creative made only for representation purpose, in no way this is a real Aadhaar ID

This API facilitates KYC verification, ensuring that companies can conduct business safely, quickly, and intelligently. It streamlines what was once a week-long process into a matter of minutes, bolstering both efficiency and security.

The Aadhaar Verification API is essential for businesses and financial institutions in establishing customer credibility. It allows for the validation of essential information such as full name, address, mobile number, and other relevant data.

Moreover, Perfios’s Aadhaar Verification API exemplifies a robust and efficient solution in this domain. It offers features like real-time verification, compliance with Aadhaar guidelines, fraud detection, and a user-friendly interface. This API significantly reduces onboarding time, making it a valuable asset for efficient and secure operations.

Understanding KYC: Key to Secure Identity Verification

Know Your Customer (KYC) has become a cornerstone in the world of financial transactions and identity verification in India. The KYC process is a mandatory procedure for customers prior to opening bank accounts, updating personal details, investing in mutual funds, or engaging in other financial activities.

It’s a critical step in establishing and validating a customer’s identity, address, and financial status, utilizing tools such as PAN (Permanent Account Number) and Aadhaar card verification through APIs.

The Union Budget 2023-24, presented by Finance Minister Nirmala Sitharaman, emphasized the importance of streamlining KYC processes, reflecting a shift towards a more efficient, risk-based approach. This proposal aims to leverage digital infrastructure, like the government’s digital locker, to store key documents, including PAN and Aadhaar, thereby facilitating a more dynamic KYC process.

Furthermore, the fintech sector in India, anticipated to reach a staggering $1.3 trillion by 2025, is increasingly integrating digital public infrastructure, including Aadhaar and UPI (Unified Payments Interface), for KYC and other services. This integration signifies a transformative shift in the financial services landscape, making KYC procedures more accessible and secure for a vast population.

The evolution of KYC in India, particularly through the integration of Aadhaar Verification APIs, underscores the nation’s commitment to enhancing the security and efficiency of identity verification. This not only fortifies the financial sector against fraud but also paves the way for more inclusive financial participation, reflecting India’s ongoing journey towards a more digitized and secure economic ecosystem.

Aadhaar Verification API and its Usage

As of 2023, the Aadhaar system has evolved into a vital component of India’s financial infrastructure, boasting over 1.3 billion registered users. This extensive reach has revolutionized the provision of digital services, particularly in the realm of electronic Know Your Customer (eKYC) for financial institutions.

Aadhaar eKYC, a critical part of this transformation, is an online process enabling the verification of an individual’s identity using their Aadhaar number. This innovative approach effectively removes the need for physical documents, thereby accelerating and simplifying the verification process for both businesses and consumers.

The implementation of Aadhaar eKYC has multiple benefits. It offers speed and convenience by reducing the verification process to mere minutes, eliminating the need for lengthy paperwork and physical visits to financial institutions.

This efficiency significantly reduces the costs associated with customer onboarding and KYC compliance, since it negates the need for physical documents and manual identity verification processes.

Aadhaar eKYC relies on biometric and demographic data, which enhances the accuracy of identity verification compared to traditional methods dependent on physical documents. This accuracy is crucial in reducing the risks of fraud and identity theft, thereby ensuring secure financial transactions.

Moreover, Aadhaar eKYC has been pivotal in driving financial inclusion, especially in rural areas where traditional KYC processes were often a barrier. This inclusion is evident in the fact that 85% of Indian consumers prefer using Aadhaar eKYC over traditional KYC processes.

The Reserve Bank of India’s mandate that all regulated financial institutions must adopt Aadhaar eKYC for customer onboarding by 2024 further underscores its importance. This move reflects a national commitment to digital transformation in the financial sector.

Additionally, the fintech sector in India, forecasted to reach $1.3 trillion by 2025, is leveraging Aadhaar eKYC to develop innovative products and services, such as digital lending platforms and mobile payment applications.

This innovation is a testament to the Aadhaar system’s impact on the financial landscape, marking a significant shift towards a more inclusive and digitally empowered economy.

Benefits of Aadhaar Verification API

● Identity Verification: Vital for sectors like banking, telecommunications, and government services, this API ensures accurate identity verification. It’s essential in preventing fraud and maintaining the integrity of transactions, a crucial factor in these sectors where identity verification is paramount.

● Fraud Prevention: With the potential for significant financial losses and reputational damage, Aadhar Card fraud is a critical concern. The Aadhaar Verification API addresses this by authenticating Aadhar Card details, detecting forged or tampered cards, and thus reducing the risk of identity theft and unauthorized access to services.

● Regulatory Compliance: Many industries are mandated by regulatory authorities to perform Aadhar Card verification for certain transactions. The API aids in adhering to these legal requirements, ensuring compliance and avoiding penalties related to non-compliance.

● Efficient Service Provisioning: The integration of this API streamlines service provisioning processes. By automating Aadhar Card details verification, businesses can onboard customers more swiftly and efficiently, enhancing operational efficiency and the overall customer experience.

● Data Integrity and Security: Direct connection with the UIDAI database via the API guarantees the integrity and security of Aadhar Card information. It ensures that the data retrieved is accurate and tamper-proof, thereby enhancing data security and reducing the potential for data breaches or unauthorized access.

● Seamless Integration: The Aadhaar Verification API is designed for compatibility with various platforms and systems, facilitating smooth integration into existing infrastructures. This feature ensures a hassle-free and efficient verification process for customers.

● Trust and Credibility: Utilizing the Aadhaar Verification API demonstrates a business’s commitment to secure and reliable transactions. This approach builds trust and credibility among customers, who feel more confident knowing their Aadhar Card details are verified accurately and protected.

Perfios’s Unique QR-Based Aadhaar Verification API

Perfios’s Aadhaar Verification API is revolutionizing the identity verification process in India, especially within the KYC framework.

With the advent of their seamless QR-based Aadhaar verification, Perfios has simplified and streamlined the KYC process remarkably. By simply scanning the Aadhaar QR code using smartphones, customers can effortlessly verify their Aadhaar cards, making the KYC process frictionless.

Notably, an impressive 90% of India’s Aadhaar Cards are verified using Perfios’ Aadhaar Verification APIs, indicating its widespread adoption and efficiency.

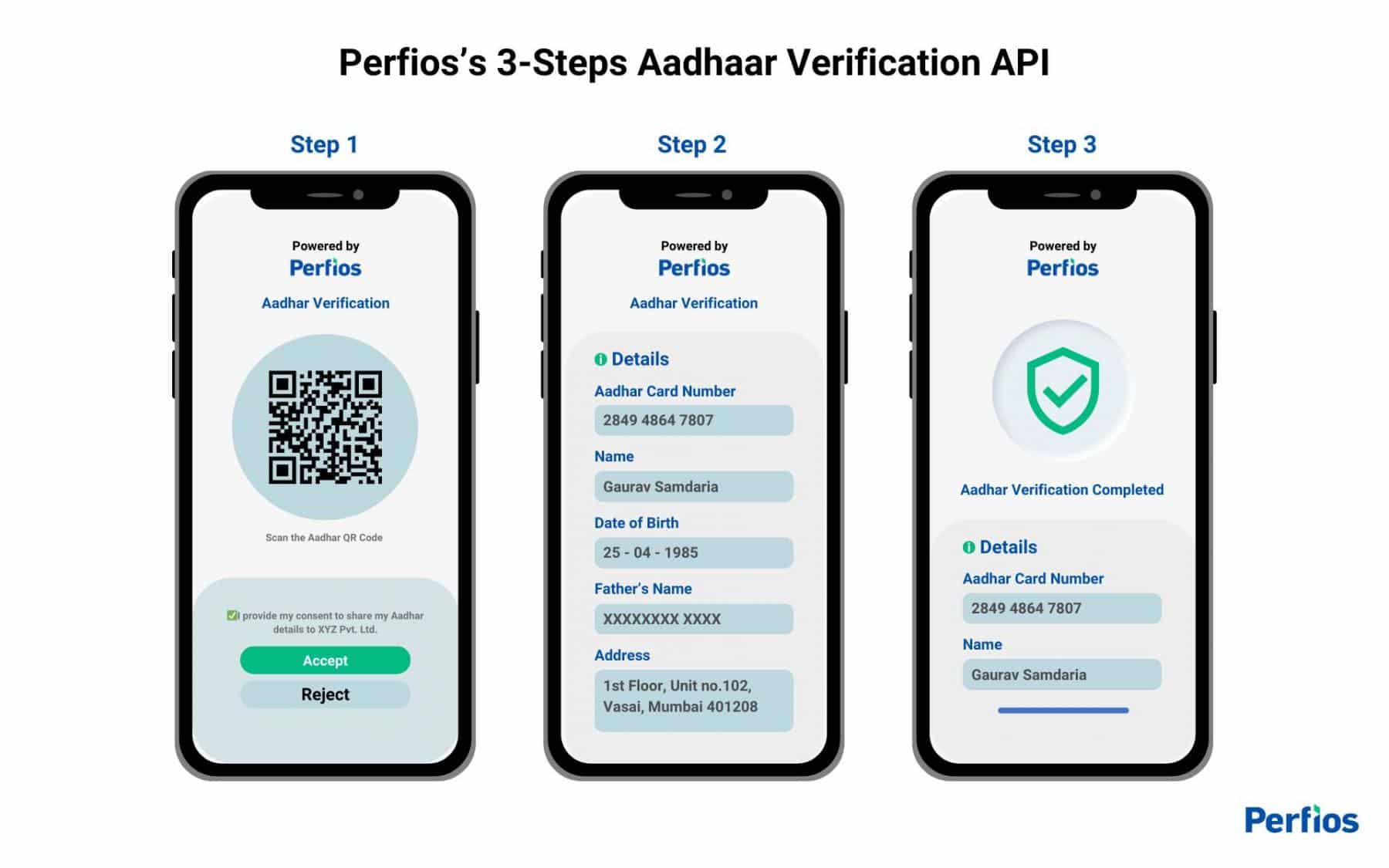

The verification process with Perfios’s API is a simple 3-step Aadhaar QR verification. Initially, the customer scans the QR code on the Aadhaar card using a smartphone during the onboarding KYC process.

Upon successful scanning, the API captures all demographic information in real-time. Finally, extracted details such as demographics, photo, email, mobile number, masked Aadhaar, and signature value are verified instantly. This process exemplifies the efficiency and speed of Perfios’s API in handling KYC verifications.

One of the key advantages of using Aadhaar QR over Aadhaar XML for verification is the significant reduction in Turnaround Time (TAT). It eliminates the need to provide the Aadhaar number or upload the XML file, greatly simplifying the process.

Additionally, Aadhaar QR-based verification is robust against system outages and intermittent availability, ensuring consistent service delivery. Moreover, the QR-based details verification is 100% compliant with RBI’s KYC Master Directions, making it a reliable and regulatory-approved solution for financial institutions and businesses.

Conclusion

Aadhaar Verification API stands as a beacon of innovation and efficiency. Its integration into various sectors has streamlined identity verification, resonating with India’s digital transformation journey. With the fintech sector in India projected to reach $1.3 trillion by 2025, the role of technologies like Aadhaar Verification API becomes increasingly pivotal. It’s not just about the numbers but the qualitative leap towards a more secure, compliant, and user-friendly digital environment. This progression, marked by the adoption of advanced solutions like Perfios’s Aadhaar Verification API, is setting a new benchmark in digital identity verification, opening doors to a more inclusive and digitally empowered future.

Get the API keys for a free trial today

About Perfios:

Perfios Software Solutions is India’s largest SaaS-based B2B fintech software company enabling 900+ FIs to take informed decisions in real-time. Headquartered in mumbai, India, Perfios specializes in real-time credit decisioning, analytics, onboarding automation, due diligence, monitoring, litigation automation, and more.

Perfios’ core data platform has been built to aggregate and analyze both structured and unstructured data and provide vertical solutions combining both consented and public data for the BFSI space catering to their stringent Scale Performance, Security, and other SLA requirements.

You can write to us at connect@perfios.com

For more Such information contact us@ https://solutions.perfios.com/request-for-demo