A recent study by Genesys looked into how banks approach customer experiences. It revealed that leaders that focus on personalization, innovation, and building trust, have an edge over competitors. For instance, they excel in tailoring products and services to meet their customers’ real-time needs and life stages, far better than their competitors (38% compared to 26%).

In the face of economic uncertainty, the importance of delivering personalized financial experiences to consumers has grown exponentially. Investing in the future of customer experience is not a choice banks can afford to overlook – it’s a pivotal move that benefits both their customers and their bottom line.

8 Reasons Why Personalization in Banking is Important

72% of leaders firmly believe that offering personalized products and services helps in nurturing greater customer loyalty, as per the Genesys study. This explains why financial institutions are actively redefining their approach to cater to evolving customer demands. Driven by the wealth of data derived from everyday transactions, banks are progressively harnessing data analytics to craft customized banking experiences. To grasp the critical significance of personalization, let’s explore the eight key factors propelling this paradigm shift within the banking sector.

1. Increased acquisition ROI

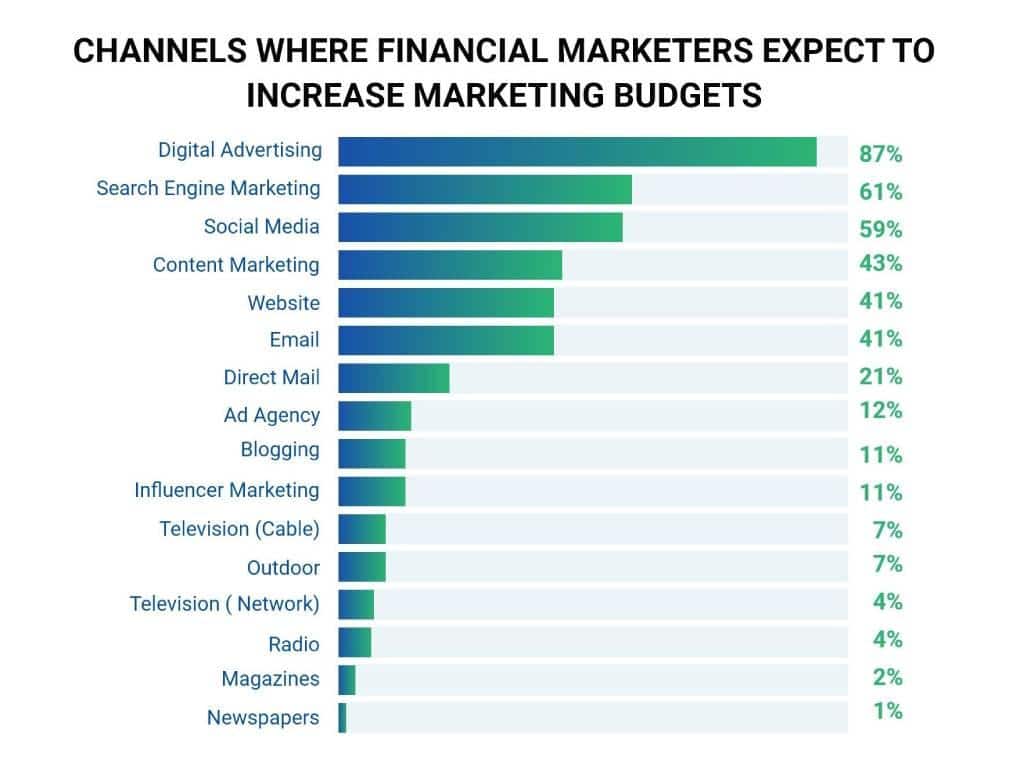

Today, the competition to win customers isn’t just about having a physical presence; it’s about offering something special in the digital world. This change has increased customer acquisition costs, with banks resorting to elevated spending on paid media campaigns and referral programs. A research study by The Financial Brand revealed that digital advertising is the top priority for banks and financial institutions, with 87% of them planning to increase their digital advertising budgets in the next few years.

However, what remains to be addressed is the rising demand for personalized experiences, which customers expect from their first interaction with a bank. The opportunity for optimization lies in post-click experiences. For instance, leveraging basic campaign data from ads and social networks can enable banks to tailor their websites to individual visitors upon arrival.

Another example of this is when a user clicks through a Facebook ad targeting salaried professionals, the website can instantly recognize this and provide content, recommendations, offers, or products that specifically cater to them. Furthermore, the integration of machine learning algorithms allows continuous refinement of these personalized experiences, ensuring that visitors consistently encounter the most relevant content over time.

This on an average not only improves the deal size but also helps companies drive 40% more revenue from personalisation when compared to their competitors, as evident from a 2021 study by Mckinsey.

2. Higher engagement

Personalization extends beyond the initial phase of attracting customers to fostering continuous engagement throughout the customer’s journey. Alongside catering to long-term objectives like loyalty and digital wallet usage, it can also immediately impact crucial aspects such as account activation, early-month performance, mobile wallet integration, and reducing customer attrition.

According to a recent study by MoEngage, banks that implement personalized email campaigns observe a staggering 100% increase in unique opens when triggered by customer events. Furthermore, click-through rates (CTRs) witness a remarkable surge of up to 20 times when emails are dynamically personalized. Banks can effectively boost account activation, especially for new customers, by sending personalized messages shortly after the onboarding process begins.

Behavioral data is a valuable resource in this context. It allows banks to understand a visitor’s location and behavior, helping financial institutions identify inactive customers. Through this data, they can re-engage customers with relevant promotions based on their past spending habits. A notable example is the approach employed by Wells Fargo ATMs. They utilize a customized welcome screen, tailoring it to an individual’s specific usage patterns. A personalized ‘favorites’ menu presents customers’ most frequently used transactions, granting them direct access to their desired functions without navigating the standard menu.

3. Lower attrition rates

In an age where banking customers increasingly embrace digital comforts such as tailored content selection, instant gratification, digital convenience, and seamless omnichannel experiences, the expectations have evolved. Today’s consumers demand more from their banks. In fact, a considerable 40% of banking customers are open to leaving their primary bank for a better digital shopping-like experience.

Personalization is the key for banks to not only meet but exceed these evolving expectations, strengthening customer loyalty and reducing attrition rates. When customers feel their needs are understood and met with personalized solutions, they’re more likely to remain loyal. Proactive engagement, such as notifying customers about fee changes or offering personalized savings plans, reinforces the perceived value of the banking relationship and discourages customers from seeking alternatives.

4. Stronger customer loyalty and longevity

Data from the Accenture report suggest that empathetic banking leaders hold a distinct financial advantage, when banks are empathetic, customers feel valued.

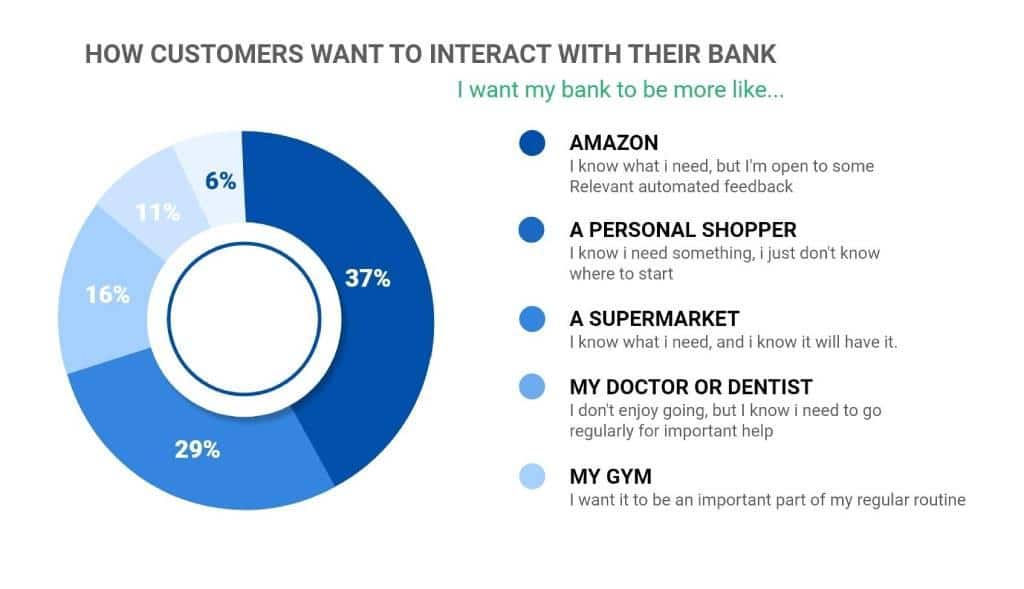

Acquiring customers is not the only challenge. Once a financial institution has successfully acquired and engaged customers at a foundational level, the bigger challenge becomes inspiring loyalty and maximizing customer lifetime value. With half of consumers wanting their bank to be more proactive in providing relevant financial information and advice, utilizing personalized offers, educational content, and advisory services becomes a determining factor between a short-term customer and a long-term brand advocate.

It’s always a good practice for banks to recommend additional items based on individual preferences, like travel perks or luxury credit cards. Adding real-time social proof from other customers who are happy with those products can also make the customer feel more confident about their choices.

5. Higher upsells and drives revenue

Personalization plays a crucial role in boosting customer engagement and driving higher sales and revenue. According to a McKinsey study, banking personalization can reduce acquisition costs by as much as 50% and increase revenues by 5 to 15%. By deeply understanding each customer’s unique needs and preferences, banks can offer additional products or services tailored to their interests.

For instance, if a customer frequently travels, the bank can intelligently recommend services like travel insurance or currency exchange, aligning with the customer’s lifestyle. This personalized approach strengthens the customer-bank relationship and increases revenue through upselling complementary offerings.

6. Better User Experience

User experience is the heart of modern banking, and personalization is the compass guiding banks toward it. Think about the kind of customization you enjoy on platforms like Netflix, where it suggests movies and shows you might like. This personalized approach is beginning to shape the future of digital banking.

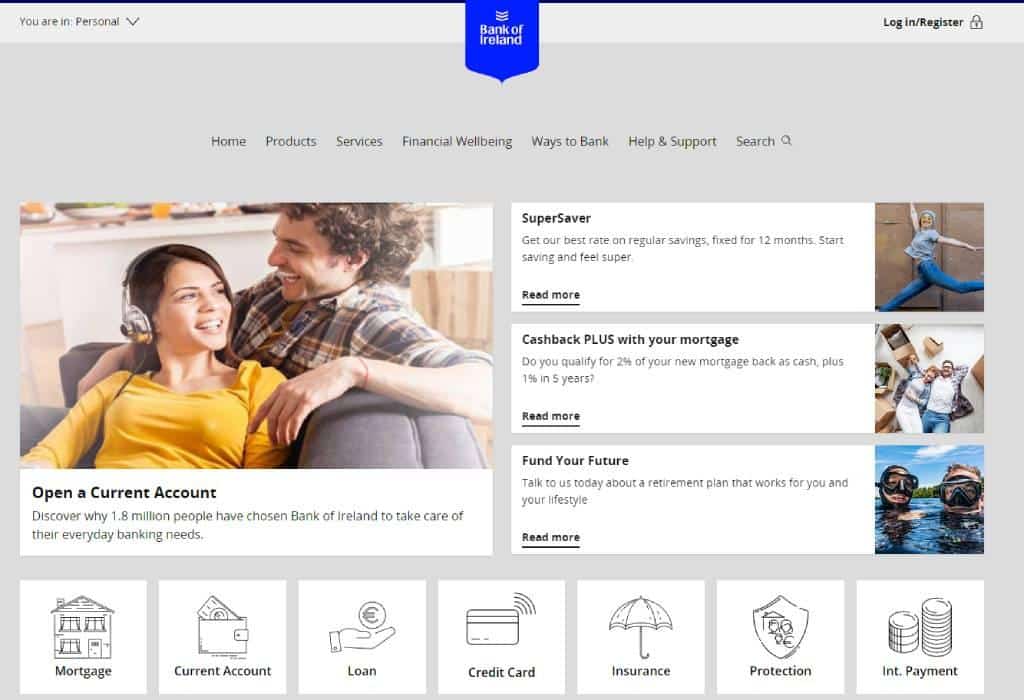

For instance, the Bank of Ireland has embarked on a journey to become the ‘Netflix of Banking.’ They’re utilizing data science, artificial intelligence, machine learning, and analytics to realize this vision. Their goal is to accurately recommend the right products and offerings based on what’s happening in their customers’ lives. It’s like having a bank that understands your financial needs and offers the right solutions at the right time.

Customers now expect their banking experience to be as seamless and user-friendly as their favorite apps and websites. Personalization is the bridge that connects this expectation with reality, ensuring that every interaction with the bank is a tailored, user-centric experience. This, in turn, fosters satisfaction and loyalty, as customers are more likely to stick with a bank that understands and caters to their individual needs and preferences.

7. Improved Product Adoption

Have you seen how Amazon’s recommendation engine works? It examines your shopping habits and suggests products you might like based on your purchase history. Banks can employ a similar approach, analyzing transaction data and user behavior to recommend the right financial products. By doing so, they guide customers to explore a range of offerings, from credit cards to investment options, fostering better product adoption and ultimately broadening the bank’s portfolio.

Incorporating personalization into product recommendations is a proactive approach that benefits the customer by simplifying the decision-making process and drives growth for the bank by encouraging a diverse set of products to be adopted by a wider range of customers. It’s a win-win scenario where the customer finds value, and the bank extends its reach and revenue.

8. Reduced Friction in Onboarding, i.e. lower cart abandonment

Personalization is pivotal in simplifying onboarding, ultimately minimizing cart abandonment rates. When a bank tailors the onboarding experience to individual customers, it feels like a custom-made journey rather than a one-size-fits-all approach.

Consider this scenario: a customer begins the onboarding process, and, based on their prior interactions or preferences, they’re guided through a specific set of steps. For instance, if they’ve previously expressed interest in home loans, the process could emphasize that particular product.

This personalized approach expedites the onboarding process and reduces the likelihood of customers abandoning their applications midway. By making the experience smoother and more relevant, the bank increases the chances of onboarding a new customer, bolstering its overall growth and success. Personalization serves as a bridge, guiding customers across the onboarding chasm to become long-term, satisfied clients.

Is it High Time for Personalization in Banking?

The urgency for banking personalization is evident. Leading banks are actively pursuing this transformation in customer interactions, aiming to usher in a new era of personalized banking. Banks that successfully implement personalization at scale will gain a significant performance advantage, establishing a robust defense against disintermediation. Those institutions that rise to this challenge swiftly and excel in delivering comprehensive, end-to-end personalization will secure a formidable lead over their competitors. The imperative is clear – the time to take action is now for those yet to start this journey.

About Perfios:

Perfios Software Solutions is India’s largest SaaS-based B2B fintech software company enabling 900+ FIs to take informed decisions in real-time. Headquartered in mumbai, India, Perfios specializes in real-time credit decisioning, analytics, onboarding automation, due diligence, monitoring, litigation automation, and more.

Perfios’ core data platform has been built to aggregate and analyze both structured and unstructured data and provide vertical solutions combining both consented and public data for the BFSI space catering to their stringent Scale Performance, Security, and other SLA requirements.

You can write to us at connect@perfios.com

For more Such information contact us@ https://solutions.perfios.com/request-for-demo