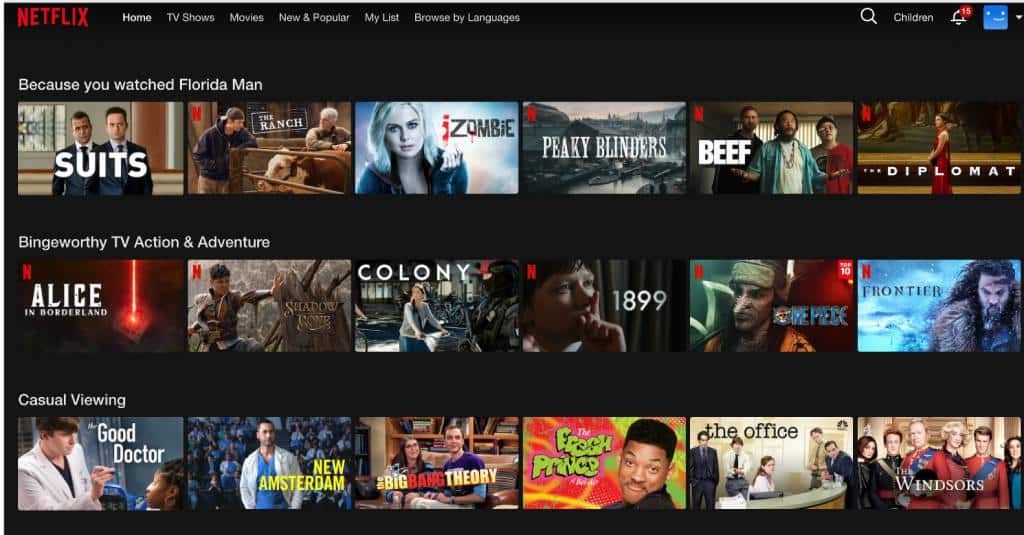

Picture this: you’re scrolling through your Netflix, Prime, or Disney+ accounts, and there it is – the ‘because you watched’ section! Most people will agree that the suggestions are in-line with their viewing preferences and very tempting to click! Ever wondered how those spot-on recommendations magically appear?

It’s the power of recommendation engines which provides contextualized and personalized viewing suggestions.

The banking industry is yet to fully latch onto this trend of using personalized recommendations. Banks still tend to rely on traditional segment-level recommendations. But Banks have access to a lot of data about their customers, to understand behavior, trends, People Like You (PLY) etc. If this data is leveraged, we can re-imagine a world where your financial needs are not just met but anticipated and catered to.

A recommendation engine for banking works by analyzing a customer’s financial data and spending habits. This helps to piece together a behavioral profile of the customer. These in-depth profiles can be used to “recommend” financial products which are contextualized and targeted to an individual.

Recommendation Engines: A Brief History

For several years, recommendation engines have been a fundamental part of various industries. Their origins can be traced back to 1992 when Xerox Palo Alto Research center developed an experimental email system – Tapestry, that utilized the first recommendation engine to sift through emails, discerning crucial content based on document details and reactions from other users.

Since then, these engines have seamlessly integrated into platforms like YouTube & Netflix that analyze viewing histories to offer tailored suggestions, transforming the way we discover content

Source – netflix

…to one of the most successful implementations on Amazon prime, where a significant chunk of revenue was being driven from the recommendation-based data collected from the target users.

In recent years, behavior-driven decision-making has permeated various sectors, including automobiles, marketing, SaaS, and manufacturing. One such industry that has been slowly moving towards personalizing customer experience has been banking.

Though this change has been slow, what started with personalized credit card skins has now evolved into Personal Finance Manager (PFM) features, to a certain extent customer specific marketing communication and now personalized customer journey’s like it is in the case of credit cards.

Why do you need recommendation engines for Banking?

There are 3 reasons why banking should consider using recommendation engines,

1. Consumer behavior has changed

Access to internet which doubled in the last decade3 has significantly changed how consumers especially in the urban and semi-urban areas engage with businesses including banking and financial services.

In fact, internationally more than 40% of bank sales now come from digital channels. Combined with the expectations set by app first platforms, ecommerce and OTT among others has led to a situation where customers expect services to be intuitive, easy to navigate and available on their fingertips via apps especially in the case of Gen Z4.

2. Banks are sitting on a huge volume of data

80% of all Indians have a bank account. Of these 66% have mobile phones5 that can be used to effectively engage with these customers but most traditional banks are barely able to make good use of it except a few..

Most banks have a treasure trove of data about their customers, right from their spending information to deposit routines to credit usage and loans.

This data combined with digital channels and with advanced analytics can not only help banks improve digital sales, improve activations but also drive financial inclusion especially to the unbanked.

3. Competition from FinTechs

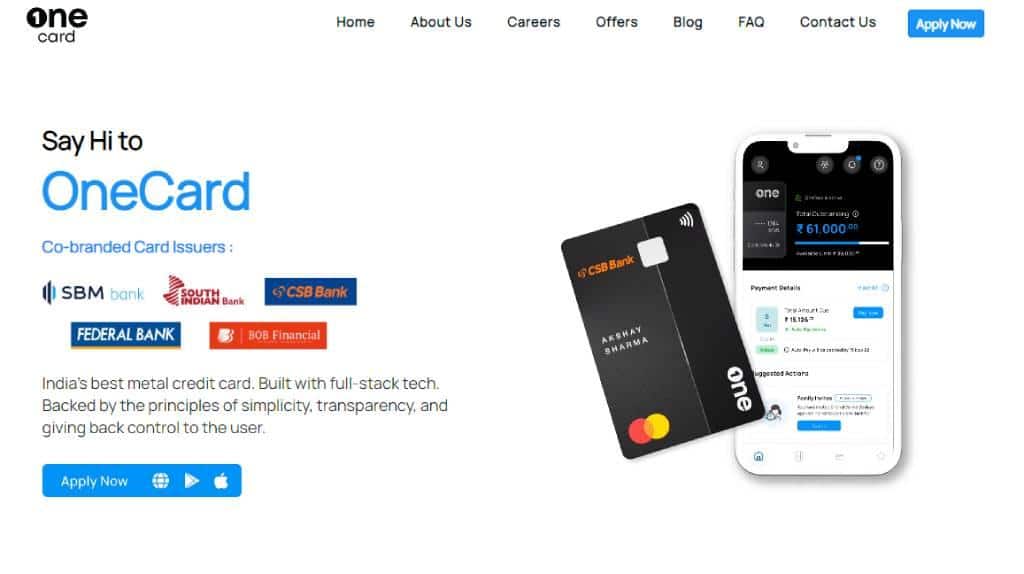

Fintech’s like OneCard are effectively using personalized digital engagement channels to account for the shortcomings of the push sales approach that most traditional banks use, visible from the unprecedented growth these fintechs are able to achieve even for products like credit cards that had seen stagnant growth for years.

The effective use of data from previous transactions, AA and bank account analysis is helping new age fintechs and neo-banks build targeted products specific to each customer’s requirement leading to higher conversion rates at a lower CAC.

How Do Recommendation Engines Function in Banking?

A recommendation engine at its core is a data filtering tool that uses machine learning algorithms to recommend products to a user based on their historical behavior. In the case of banks this would mean analyzing a customer’s previous financial behavior to recommend products like a credit card that best suit their needs.

Recommendation engines in Banking try to answer three questions:

1. Which product is best suited for this customer?

2. Why should the customer go for this product i.e. the rationale of going for the product?

3. Where should you display the offer i.e. contextualize the offer so that it is not intrusive

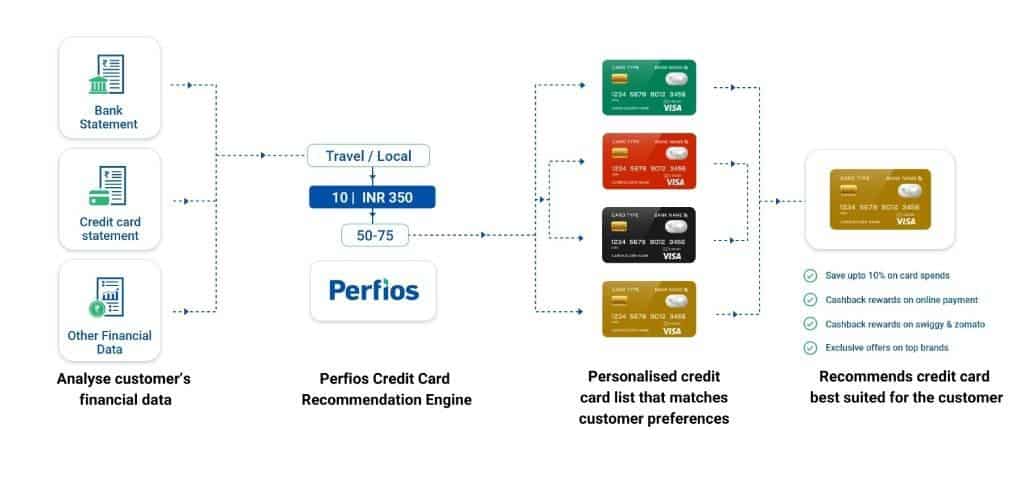

This is done by first analyzing a customer’s financial information either from bank, credit card statements or from accessing this data via an Account Aggregator (AA) based on the customer consent.

Once this data is captured and analyzed the recommendation engine profiles the customer based on the purchase category, industry and benchmarks. This benchmarking allows the recommendation engine to recommend products that are best suited for the customer needs.

Here is an example of Perfios’ credit card recommendation engine for your understanding.

Benefits of Recommendation Engines for Banking and FIs:

Here’s what recommendation engines bring to the table for banking and financial institutions:

1. Higher conversion and Lower CACs

Engaging customers with products aligned to their financial behavior typically results in increased conversion rates and reduces the effort needed to finalize a sale, ultimately leading to lower Customer Acquisition Costs (CACs).

2. Improves engagement and retention

Personalized products recommended based on the customer’s profile empowers customers to drive usage, leading to higher retention rates and an increase in engagement.

3. Drives revenue

Comprehending customers’ financial patterns empowers banks not just to suggest immediate necessities but also to offer services that could benefit customers in the future. This approach enhances the average order value and boosts conversion rates effectively.

4. Better products

Recommendation engines can also help Banks understand their customers better and design better product offerings.

Signing off…

Recommendation engines have been in use across multiple industries for some time now and are seeing increasing adoption across the banking and financial services industry over the last few years.

What started with PFM features to help customers with their financial decisioning is now using this data to also help banks drive growth across multiple product lines.

With the continued integration of recommendation engines, we anticipate even greater strides in optimizing public money management. The future holds exciting prospects, where these innovations promise to bring about profound positive changes in the way we manage finances.

Here’s to a future where technology propels us toward unparalleled efficiency!

About Perfios:

Perfios Software Solutions is India’s largest SaaS-based B2B fintech software company enabling 900+ FIs to take informed decisions in real-time. Headquartered in mumbai, India, Perfios specializes in real-time credit decisioning, analytics, onboarding automation, due diligence, monitoring, litigation automation, and more.

Perfios’ core data platform has been built to aggregate and analyze both structured and unstructured data and provide vertical solutions combining both consented and public data for the BFSI space catering to their stringent Scale Performance, Security, and other SLA requirements.

You can write to us at connect@perfios.com